First published November 2018

A look at the main types of cost you will find on your electricity bill, what they are and how they are billed.

It is useful to consider what costs are involved in supplying electricity and how these can be billed. Here are the main elements.

Fixed costs

Some components of energy supply cost do not change with the amount of energy used and are fixed over time. Examples include metering and meter reading, bill production and maintenance of the availability of the supply. These can be charged on a time basis (£ per month) or might be linked to the ‘capacity’ or size of the supply – the bigger the capacity, the higher the fixed charges.

Peak use (or maximum demand)

Suppliers and distributors need to cater for the maximum power demand of a site irrespective of the accumulated energy the site uses. Because energy is supplied ‘on-demand’, generation and distribution capacity must be on standby to cater for the possibility of the load being switched on. For smaller customers on a simple tariff, this is recovered as part of a ‘fixed charge’. For larger customers, with half-hourly meters, this is often recharged against the measured peak demand or ‘nominal capacity’ of the installation. Commonly, it is expressed as £ per kW or £ per kVA per month.

So, if in a particular month a site hits peak usage of 120kVA for just 30 minutes on a busy day, this will be identified as the maximum demand and charged at the relevant rate.

Many large ‘non-half-hourly’ users have had their invoices and/or meters changed to half-hourly rates under the P272 regulations. Customers have to be careful to check their ‘new’ kVA rates, as these may be wrong or need adjusting. Penalties for overuse are quite high, but may be worth paying if additional use is only for one or two months.

Energy

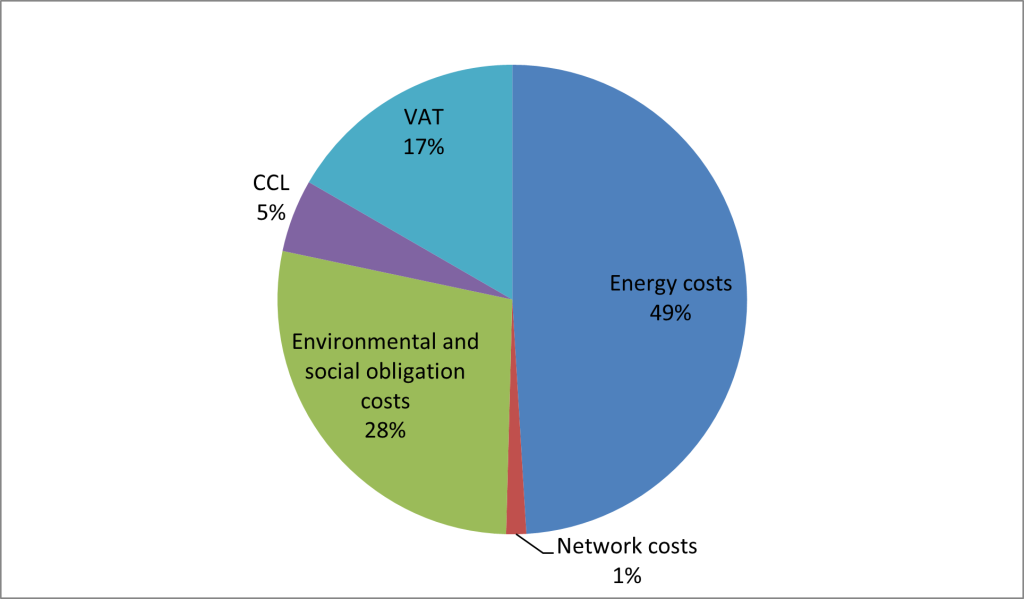

This is normally the majority of the cost and can be regarded as the ‘fuel’ component of the bill. It pays for the gas, coal, or the amortised operating costs of a renewable system which is used in generation; these costs are passed on to the end-user and are measured in kilowatt-hours (kWh). In some cases and increasingly, the non-kWh charges are becoming more significant and can represent more than half the bill.

Use of System charges

These charges are levied by the transmission and distribution companies for use and maintenance of their assets – cables, lines and transformers – and are passed through to end users. They only apply as a separate item on a bill for users who have more complex tariff structures; simpler tariffs have them ‘built-in’ to the kWh rate.

The rates are set by agreed statute and are the same for any particular customer, irrespective of who the energy supplier might be. Examples are: Transmission Use of System (TUoS) charges and Distribution Use of System (DUoS) charges. These charges change with time of day and day of the week. For larger supplies, National Grid has a ‘Triad’ charge, which is calculated from customer maximum demand at three half-hour electricity system peak times per year. The Triad charge is a ‘one-off’ reconciliation payment in the spring of each year.

Electrical taxes and levies

A number of taxes and levies are charged on the amount of energy (kWh) used in a period. They are either integrated with the p/kWh rate for the energy used and not shown explicitly on the bill, or itemised as separate components. These include Climate Change Levy, Feed-in Tariff Levy, Contracts for differences and Renewable Obligation.

CCL discount and VAT

If you have a Climate Change Agreement (CCA), check that your Climate Change Levy (CCL) discount is being applied correctly.

VAT is charged at 20% for business customers and 5% for domestic customers. Where domestic dwellings exist on site, users can apply to have split VAT for business and domestic use. If electricity use falls below a certain figure in a particular month the normal 20% rate falls to 5%.