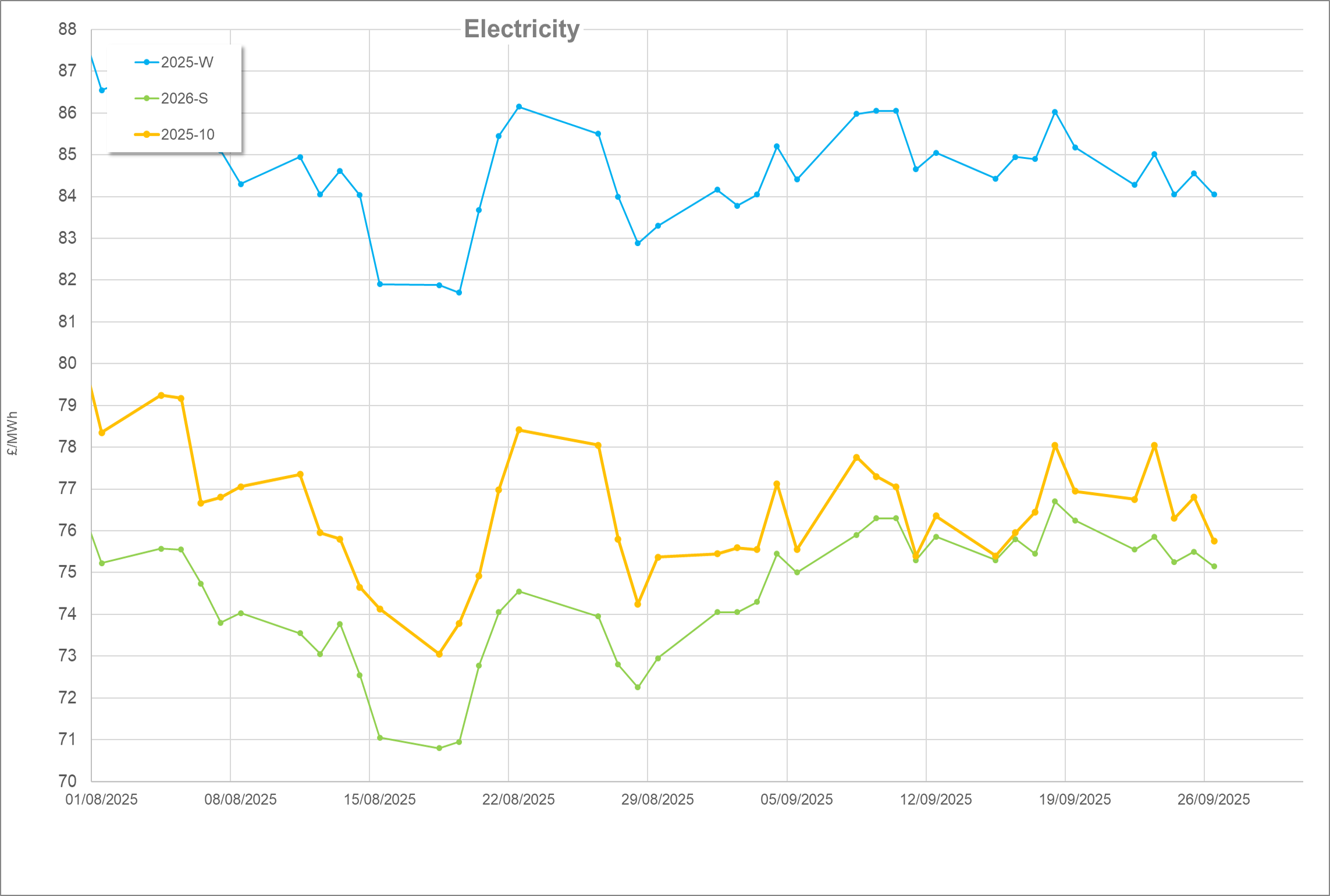

July Recap

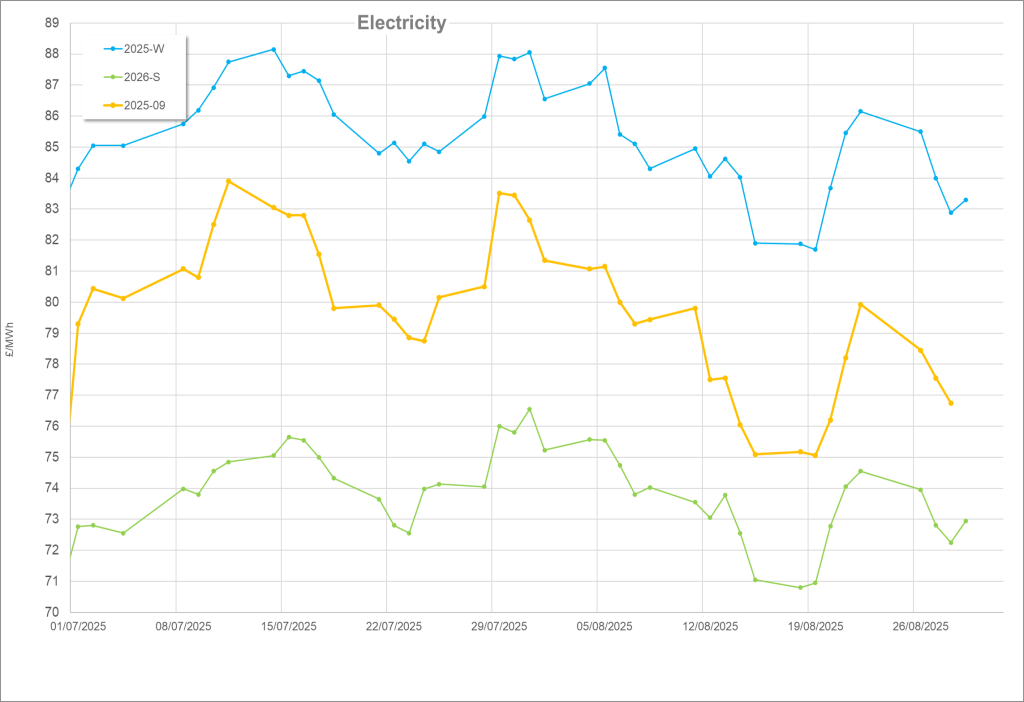

Hot and windless weather caused some issues for renewables and imported power during the month. Whilst domestically, gas was the majority source of electricity, high river temperatures in France saw some reductions in output from their nuclear fleet in response to cooling reactors.

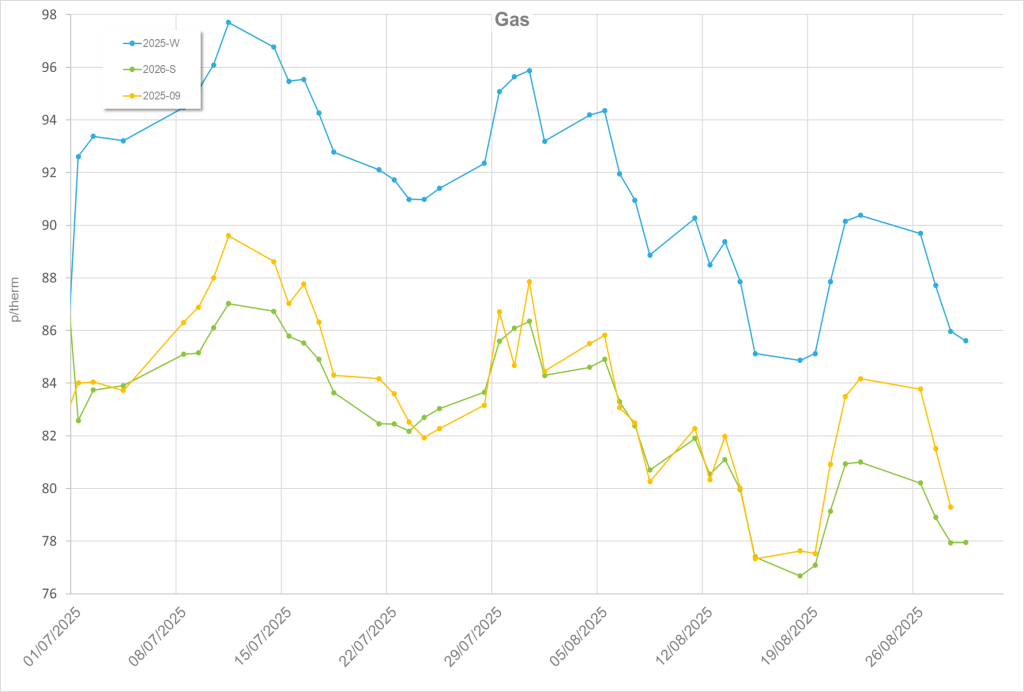

For the most part, prices decreased for gas, however hopes that this would improve the economics of injections into storage were muted. Although generally there was more gas in storage at the end of the month compared to the beginning, the difference was only slight.

Discussions with an energy supplier about this matter revealed an example of Centrica, who own Rough storage, struggling to inject due to “spread”. However, as prices typically rise in winter and soften in summer, it is surprising that more storage was not observed. In geopolitical news, it was relatively calm, although Trump’s tariff strategy remained firmly in the news.

August

Wind rebounded in August following a slump in July and pipped gas to the post by 0.5TWh for the top generator. The power demand was very similar to July and although there were slight rebounds in biomass and imported power, a 1TWh reduction in nuclear (mostly due to planned maintenance) saw gas make up the shortfall.

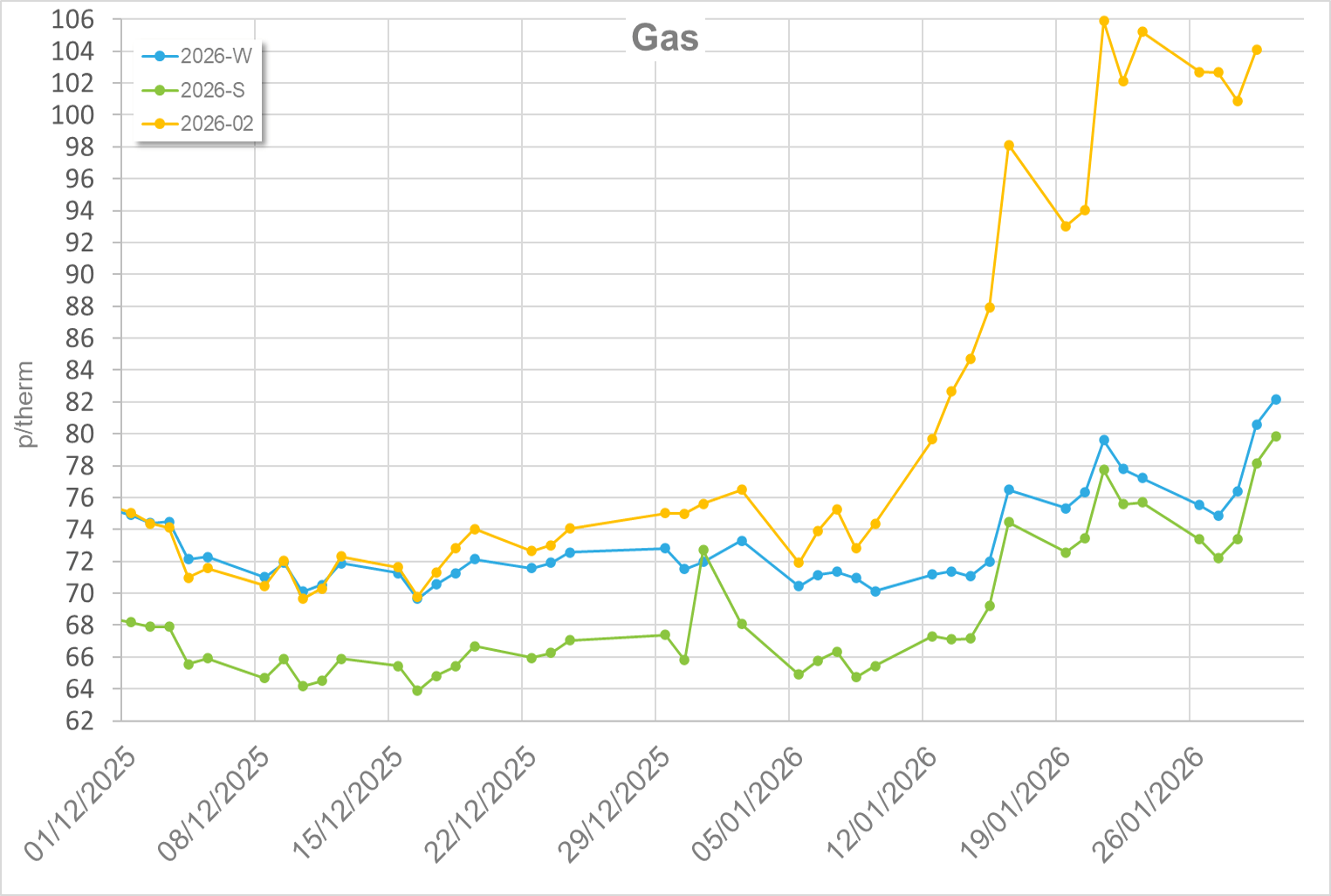

Price decreases in gas were more acute in August compared to July and initially, this saw gas storage injections rise. However, as Norwegian maintenance kicked in towards the middle/end of the month, storage levels plateaued. The end of August saw storage levels contain <50% of last year’s position, at which point in 2024 storage was more-or-less full. There were several unplanned Norwegian gas outages during the month as well as the large planned maintenance towards month end. The anticipation of the latter did see prices creep up, however they started to erode as the maintenance schedules were kept to time.

On the geopolitical front, there were a series of meetings that drew the markets’ attention. Garnering the most attention was a meeting in Alaska between Putin and Trump in an apparent attempt to broker a peace agreement in Ukraine. Some market commentators mused on Putin potentially seeking a lifting of sanctions on Russian oil and gas as a condition that creates a conflict for Trump, whose increase in LNG output to Europe is helping keep the markets stable. Russia, however, also announced a ramp up in their LNG exports with Arctic 2 sending its first shipment of LNG to China which could add significant volume to global supply.

No deal was agreed and, in short order, Trump met with EU and Ukrainian officials. It was announced that a tri-party meeting with Putin, Trump and Zelensky would be set in September which may be good news, although the markets are seemingly holding out on responding unless there is concrete news of peace. Prior to this, Putin met with Indian leaders and an oil trading agreement was struck. This caused a knee-jerk reaction from Trump who announced tariffs would be levied against India. For the most part it seems the markets have come to terms with this tactic by the US President and prices barely fluttered.

Written by Ed Kimberley