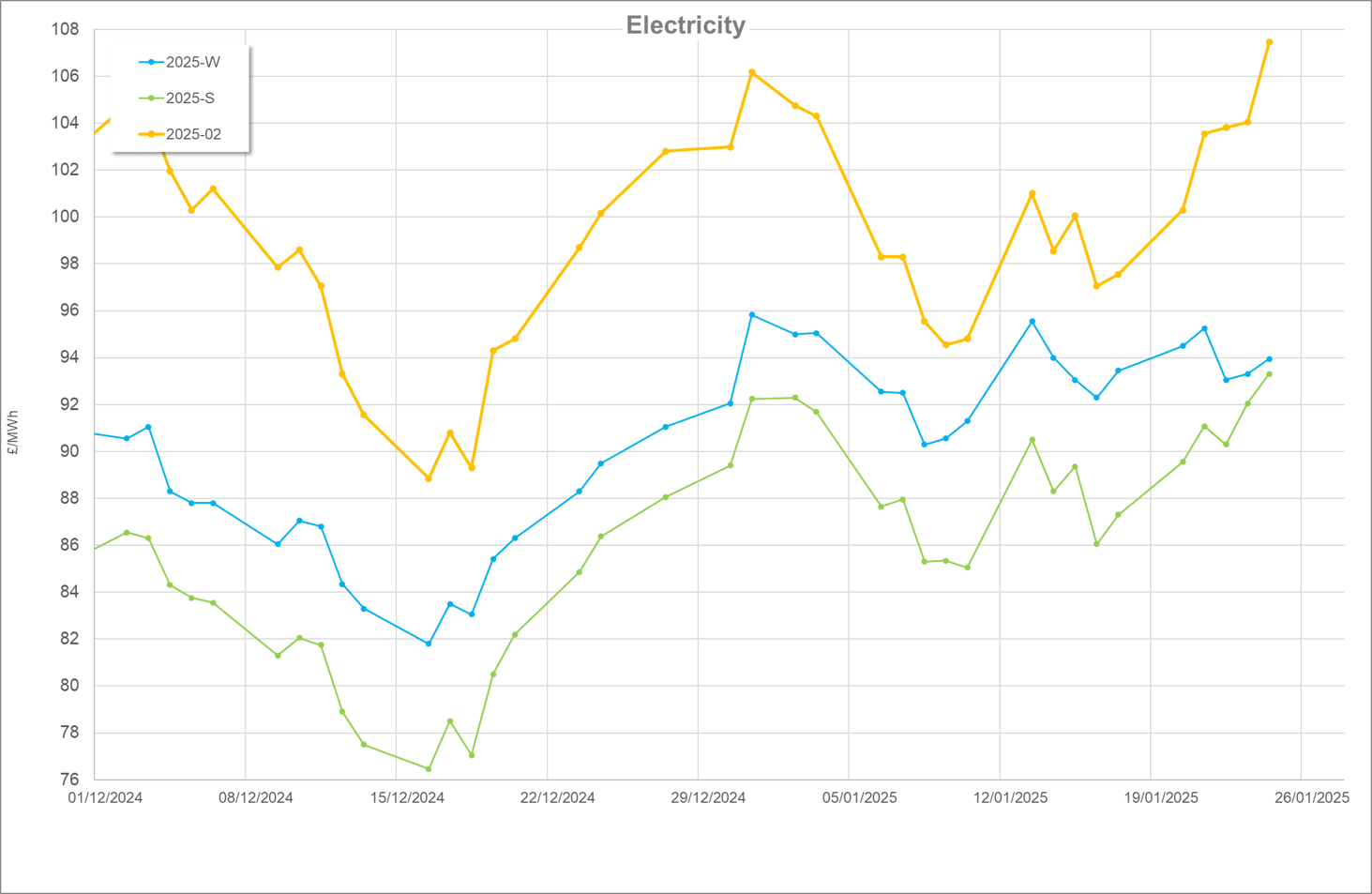

December Recap

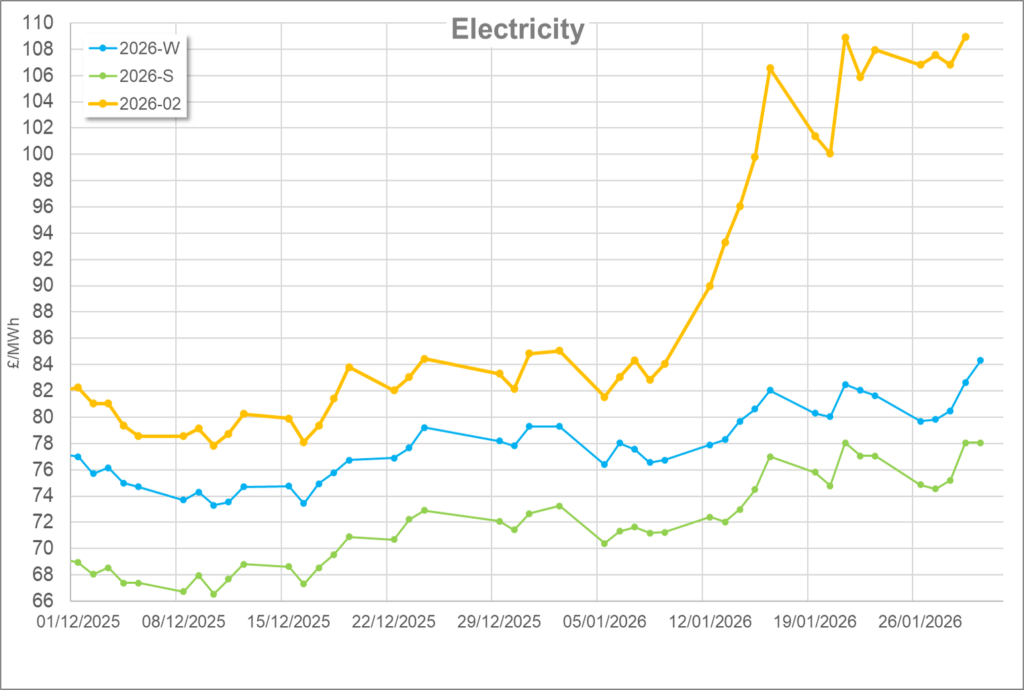

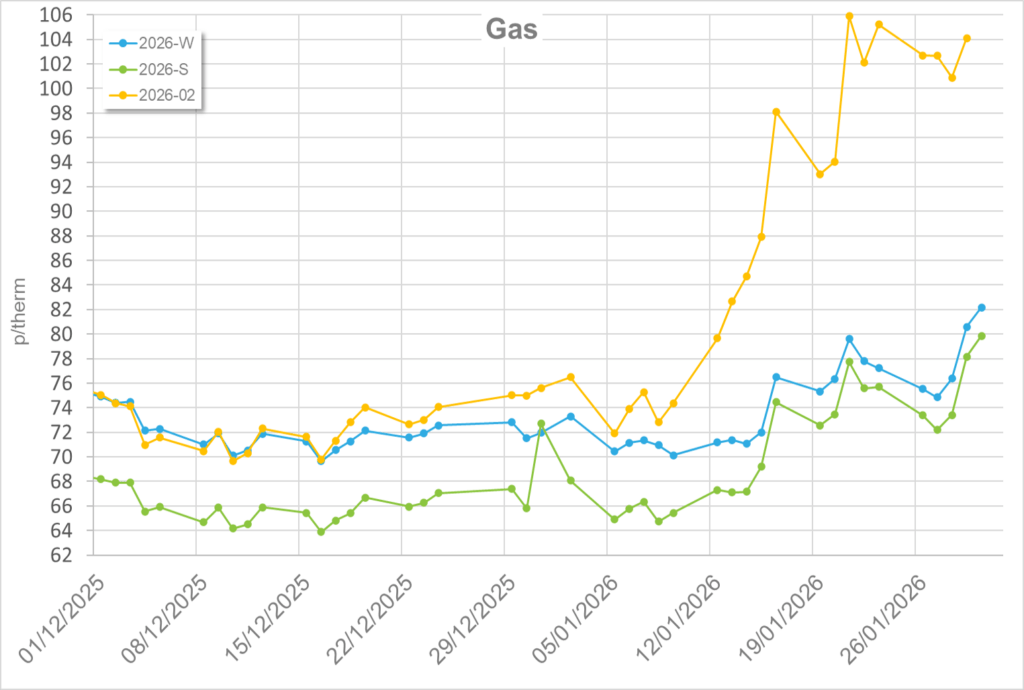

December, in terms of pricing, was a particularly calm month with prices generally flat. On the other hand, it was a particularly blustery December which saw Wind dominate Gas in the generation stakes. This was in part due to Storm Bram which stoked the turbines into action.

Temperatures were generally mild which allayed some fears of heavy price increases should the low gas storage levels be tested. Contrary to the norm, increases into storage were observed during the month, albeit only slightly.

Geopolitics were somewhat quiet for the majority of the month, however the US military exercise that led to the arrest of Venezuelan President Maduro did cause the markets some concern. Increased concerns for the energy infrastructure in Ukraine were raised as Russia targeted communal heating systems. Vladimir Putin also re-emphasised territorial policy directed at Ukraine. The bombing and blustering, however, was underlined by renewed talks of peace as the war-torn Ukraine headed into the festive period.

In news of standing charges, NESO released their penultimate draft of the increased TNUoS costs which had many businesses in the UK concerned over potential 95% increases in the charge. The charges, arriving a fortnight beyond the deadline, were on average 63% higher than current tariffs; despite some downturn on the first revision, these still pose existential challenges to businesses from April 2026.

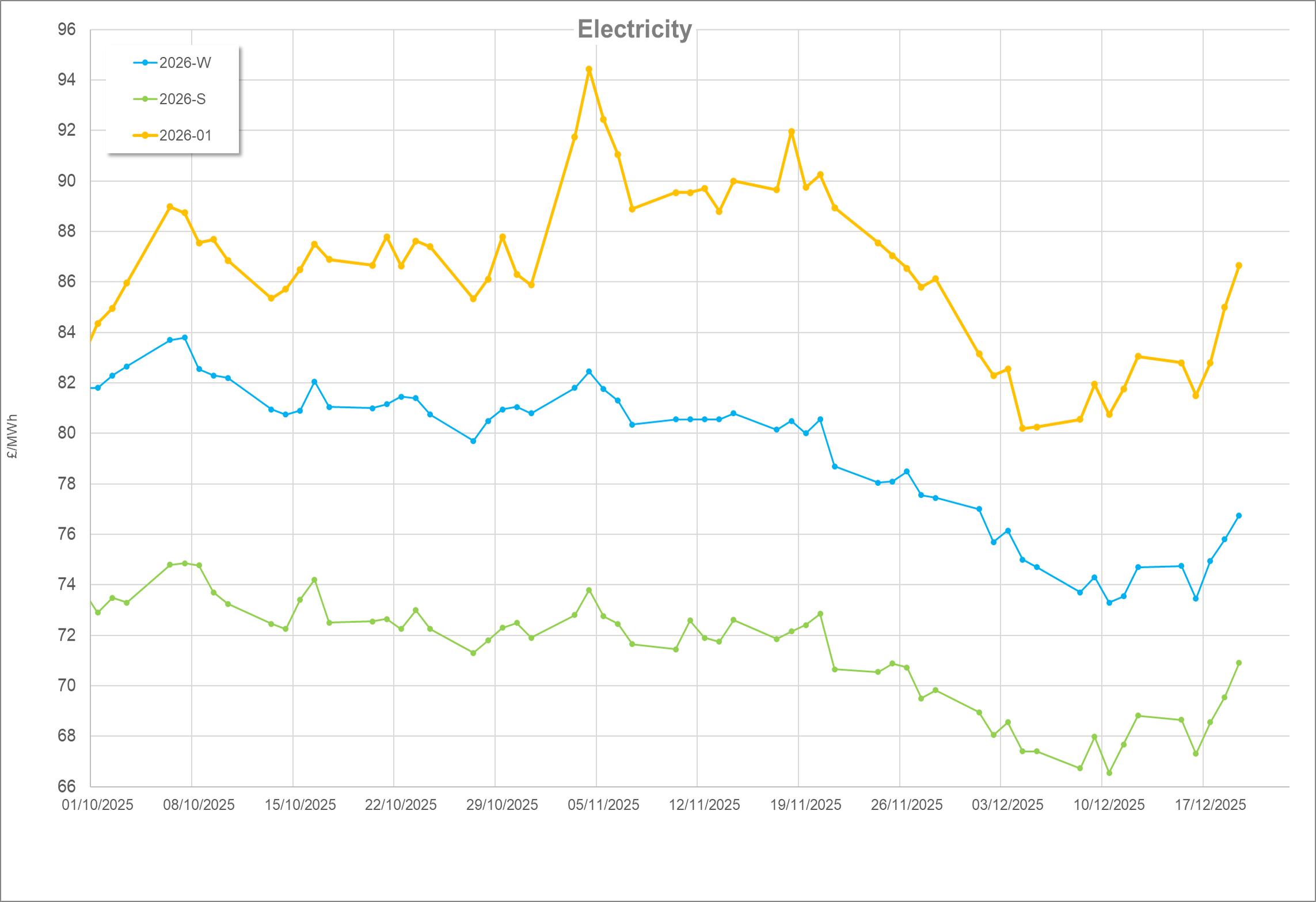

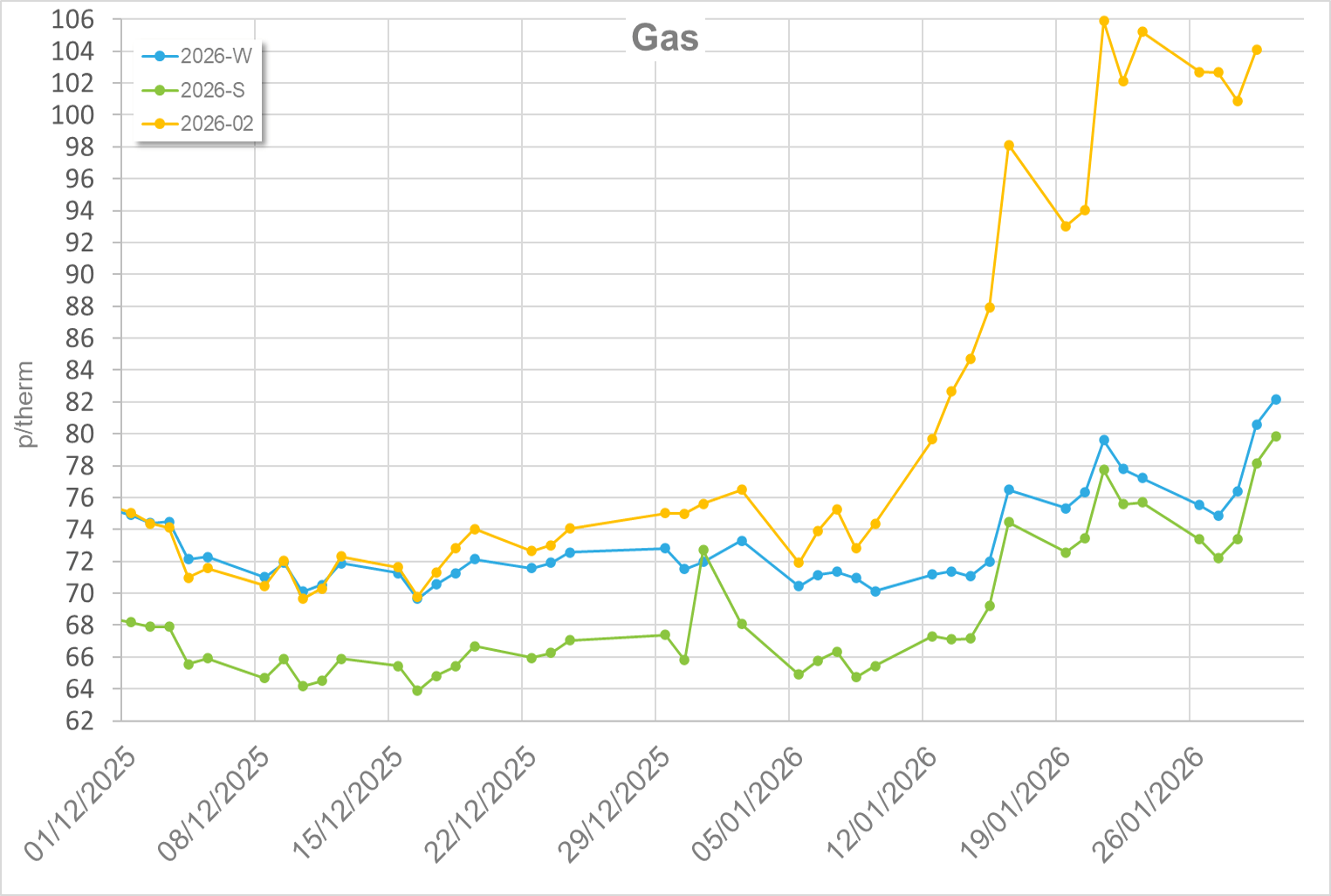

January

Early into 2026, temperatures plummeted and subsequently our gas storage stocks followed suit. LNG stocks came to the rescue as a decreased appetite from the Asian market, coupled with increased supply from the United States, mitigated pricing damage.

Wind generation was consistent between December and January, however a significant increase in power demand saw Gas called upon to make up the gap. In spite of this, Wind did still outperform Gas in generation numbers by around 1.5TWh.

Geopolitics played a prominent part in pricing during the month as protests in Iran and the subsequent government suppression came to light. This was followed by Trump simultaneously mustering the US’s naval forces in waters close to Iran and reiterating that a deal was close to be agreed regarding the Iranian nuclear programme. It is curious however, that Iran’s nuclear capability was being discussed openly as the US claimed to have destroyed the Middle Eastern nation’s Nuclear programme back in June.

Whilst things heated up in Iran, the war between Israel and Palestine finally looks like it is coming to an end with 2 phases of the 3 phase peace agreement having seemingly been completed. The 3rd phase, which is the reconstruction of Palestine, will take much longer but the fact that the short term goals have been achieved is encouraging.

Over in the United States, Trump started to make noises about the US wanting to take control of Danish-owned Greenland. This prompted some concern from the European Union and the United Kingdom. Unlike December, prices in January soared across both gas and power in short term markets. This increase held firm as we await the usual walk-back.

January Pricing Graphs

Written by Ed Kimberley