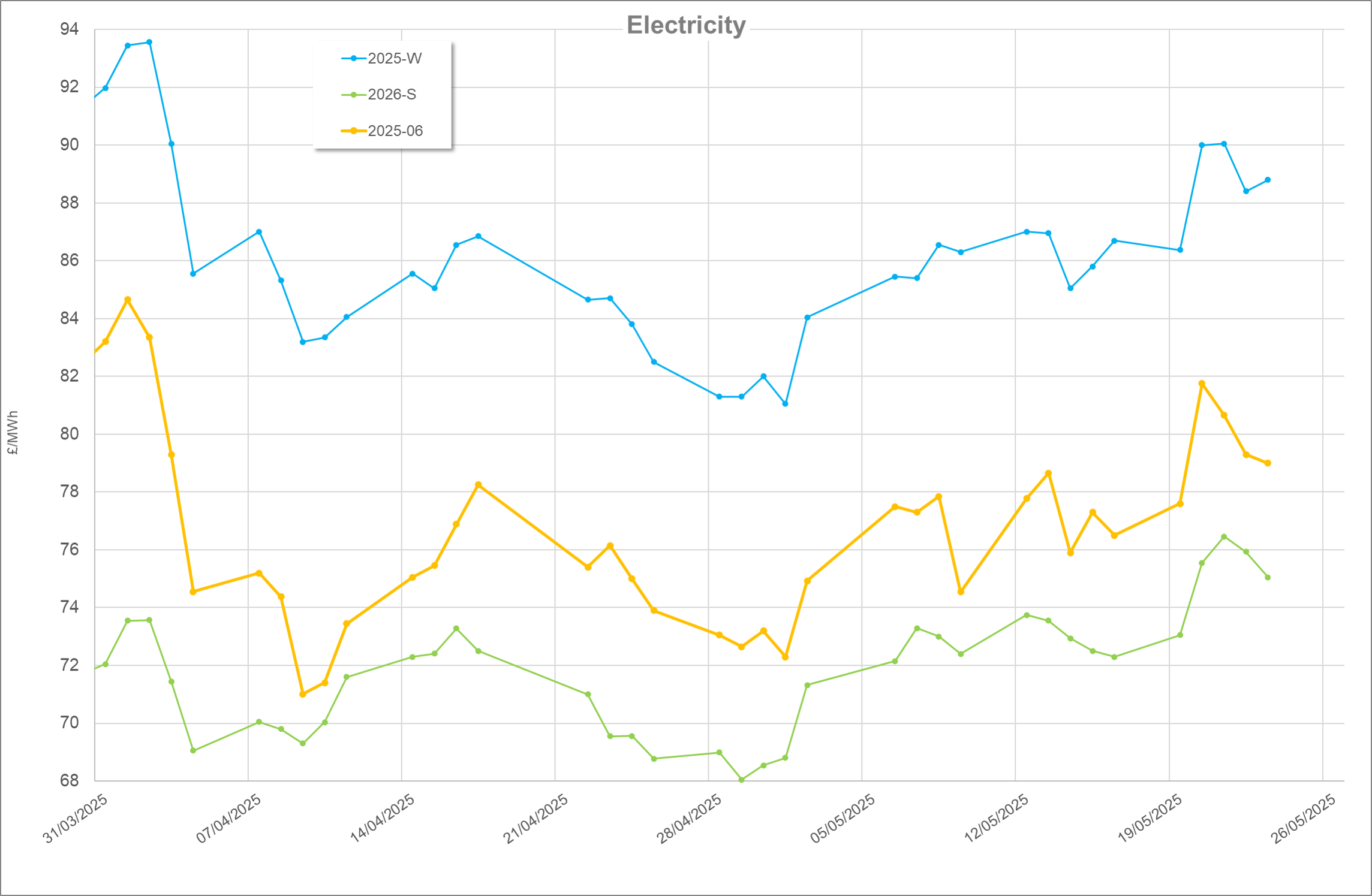

May recap

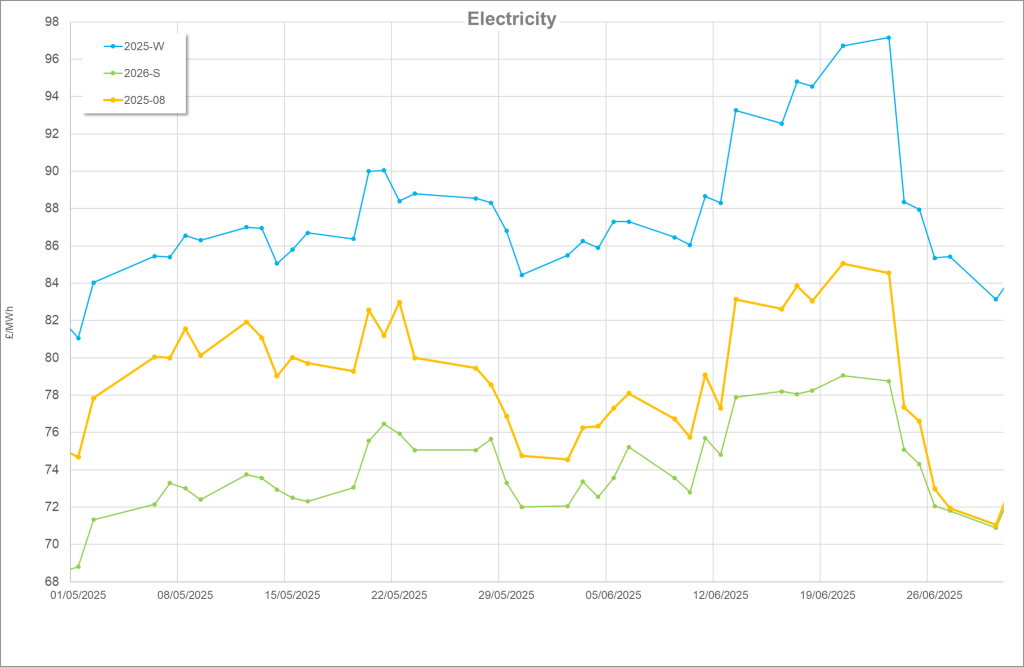

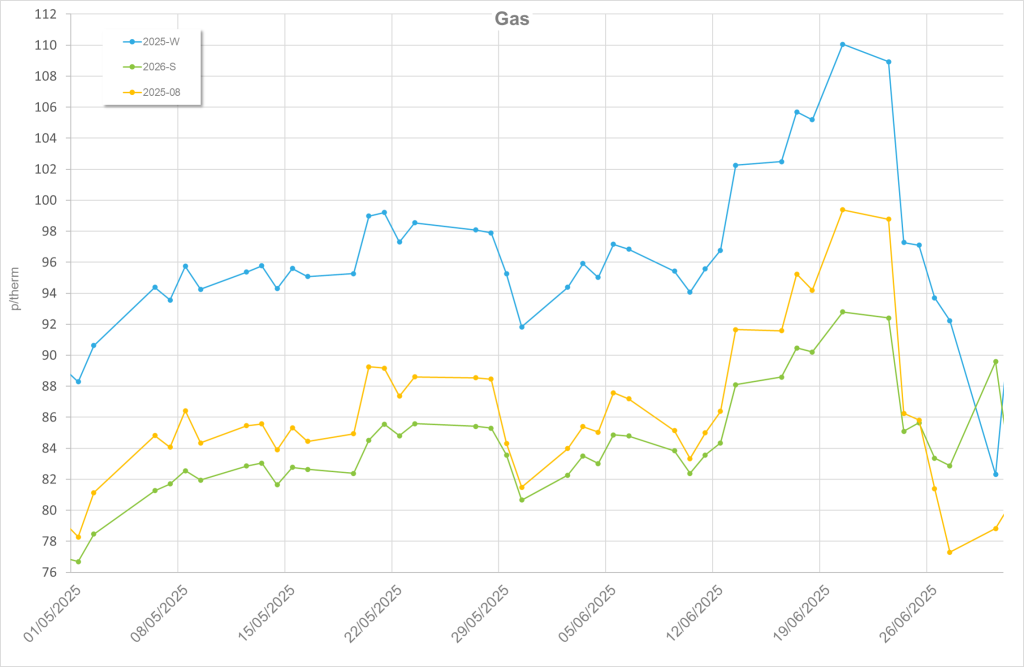

An interesting month in Energy, the EU outlines plans to sanction any remaining Russian gas and Liquefied Natural Gas (LNG) into member states. LNG was targeted by the end of the year which is ambitious. Hungary and Slovakia in particular objected to the initial plans but the roadmap set a clear state of intent by the EU regarding Russian gas going forward. Russia and Ukraine agreed to a further ceasefire, however, in a case of deja vous this was wasn’t observed with both sides blaming each other. Wind picked up significantly towards the back quarter of the month, outperforming gas by 7%. Norwegian gas maintenance went relatively smoothly, calming any fears that issues could shake the markets up as seen in previous years. Traditionally May is a weaker month for gas storage injection and 2025 was no different with levels remaining flat throughout the month, ending around 6000 GWh shy of last years position. US President Trump was in the news again after a heated tariff spat with Xi Jinping Chinas Premier. Trump was also trying to position himself at the table to help negotiate peace in the Ukraine but the war trundles on with little end in sight.

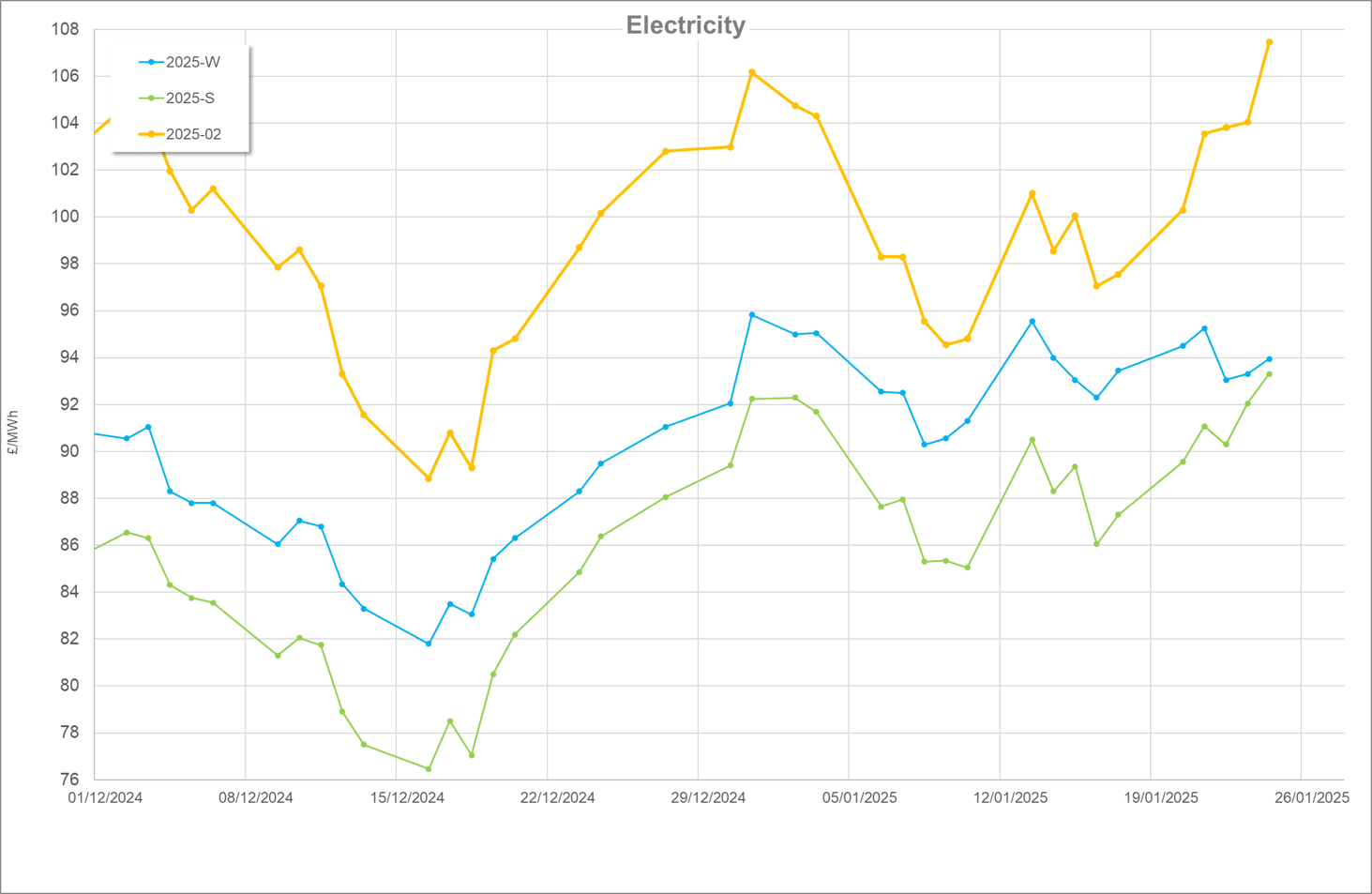

June

Towards the middle of the month prices of gas and electricity spiked dramatically due to turbulence in the middle east. Israel and Iran escalated drone and missile attacks on each other. This was then punctuated by Donald Trump confirming the US had led strikes on Iranian nuclear facilities. The subsequent fall out directly led to prices sharply increasing at this marked escalation in the conflict. There was also much concern with Iran closing the Straight of Hormuz a key passageway for Oil in particular. The price increases however, eroded as quickly as they rose. R.e. the Straight of Hormuz, market analysts suggested that Iran would risk major fallout with China if they closed it off. Curiously, despite leading strikes on Iran, the US was able to mediate a ceasefire between Iran and Israel. Which, unlike Ukraine and Russian ceasefires, was seemingly observed prompting prices to drop around and even slightly below levels seen before the most recent volatility.

Russia remained in the news as the EU modified their targets to effectively ban Russian gas and LNG, which is now targeting for 2027. There were some spikes observed in Asian LNG demand. However, this seems to have been shrugged off by markets, an encouraging sign as previously the competition for LNG has caused prices in the West to spike. This level of calm may have coincided with a meeting between Trump and Xi Jinping which was deemed positive considering the recent tariff war between the two nations. Things are delicately poised in this regard as UK gas storage dropped to just 6000 GWh during the month, >50% below last year and its lowest point in the last two years. Wind was particularly good during June increasing output on May by ~1 TWh. This was particularly good timing-wise as due to high temperatures in France, their Nuclear fleet saw reduced outputs. This is due to their reactors using river water to cool reactors, however, when river temperatures rise, reactors need to ramp down. June saw a 0.5 TWh decline from May in imported power from France.

Looking ahead

Gas Storage – market analysts are becoming increasingly concerned across the continent at the low levels of storage. As we approach the second wave of Norwegian gas maintenance and indeed Winter, this could proceed some further price increases.

Geopolitics – Russia and Ukraine continue to be in the news with the ongoing conflict there. Ukraine’s energy infrastructure has been heavily targeted by Russia and is importing large amounts of its power/gas. This could increase pressure on the supply/demand mix as we go into winter particularly taking into consideration the poor gas storage reserves. Israel and Iran are currently in a ceasefire however the long term impact of the US involvement remains to be seen.