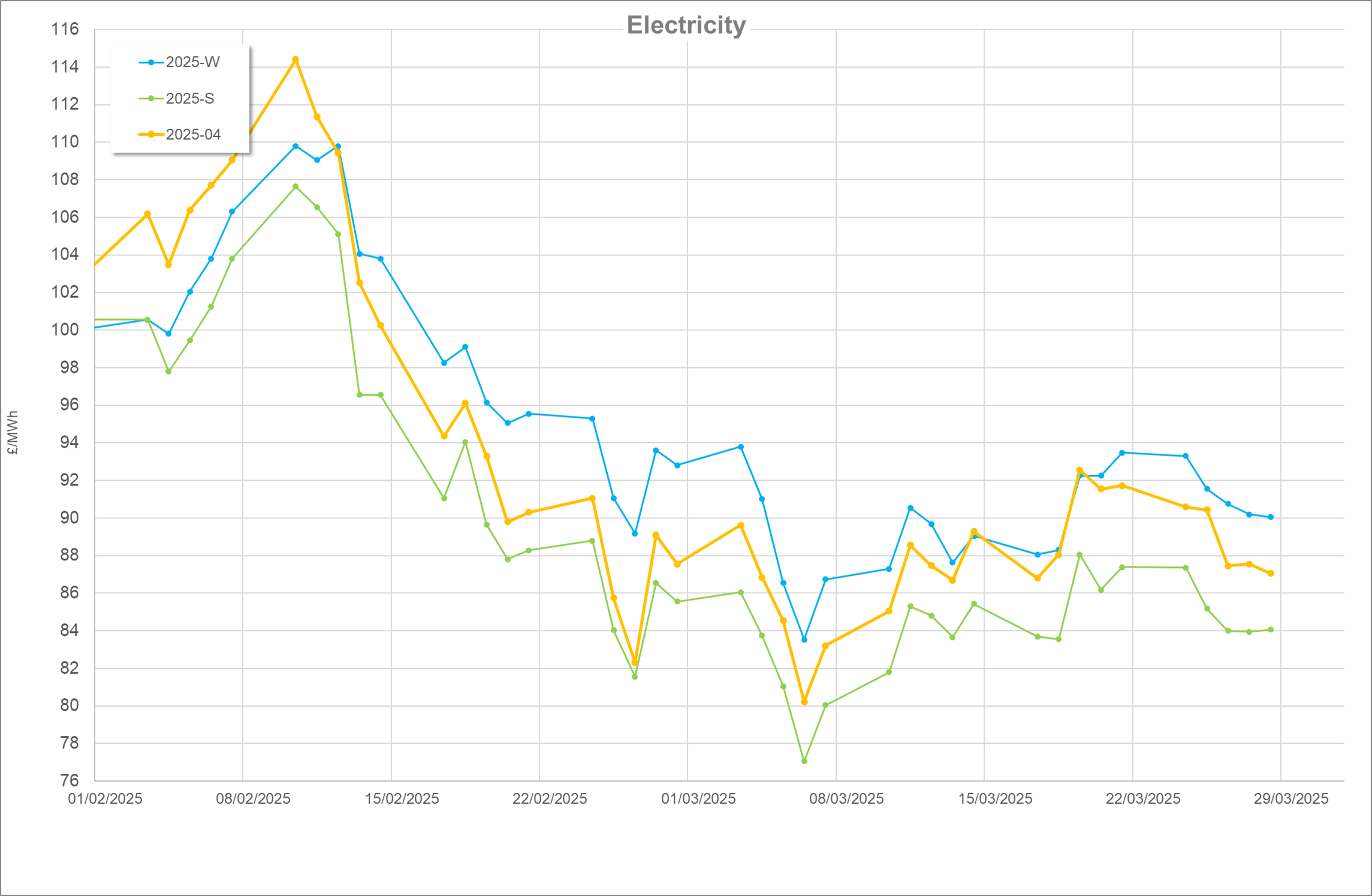

April Recap

A relatively tepid month in energy news. Gas outperformed wind in electricity generation, for context in April 2024 wind produced over twice what gas managed. UK gas storage diverged from last year’s position. During April 2024 injections were commonplace in the lead up to the 1st of the annual Norwegian maintenance windows. However, 2025 saw levels stay flat as UK struggled to inject. This lack of injection was commonplace throughout the EU with legislators announcing changes to the ongoing targets. The first dribs and drabs of Norwegian maintenance began with the bigger volumes schedule for mid-May.

The situation in the Ukraine showed signs of easing with Putin announcing there would be a ceasefire between 8-11 May (more on this later). On the final day of April, the US and Ukraine signed a ‘Natural Resources’ deal strengthening the bond between the two countries and perhaps signalling an end to the war is inching closer. Trump and Xi Jinping of China duked it out in a tariff war which culminated in a Whitehouse paper showing China faces up to 245% tariffs. China seemed to try to reason with the US saying they needed to work together, and markets seemed relatively placated by any potential fallout.

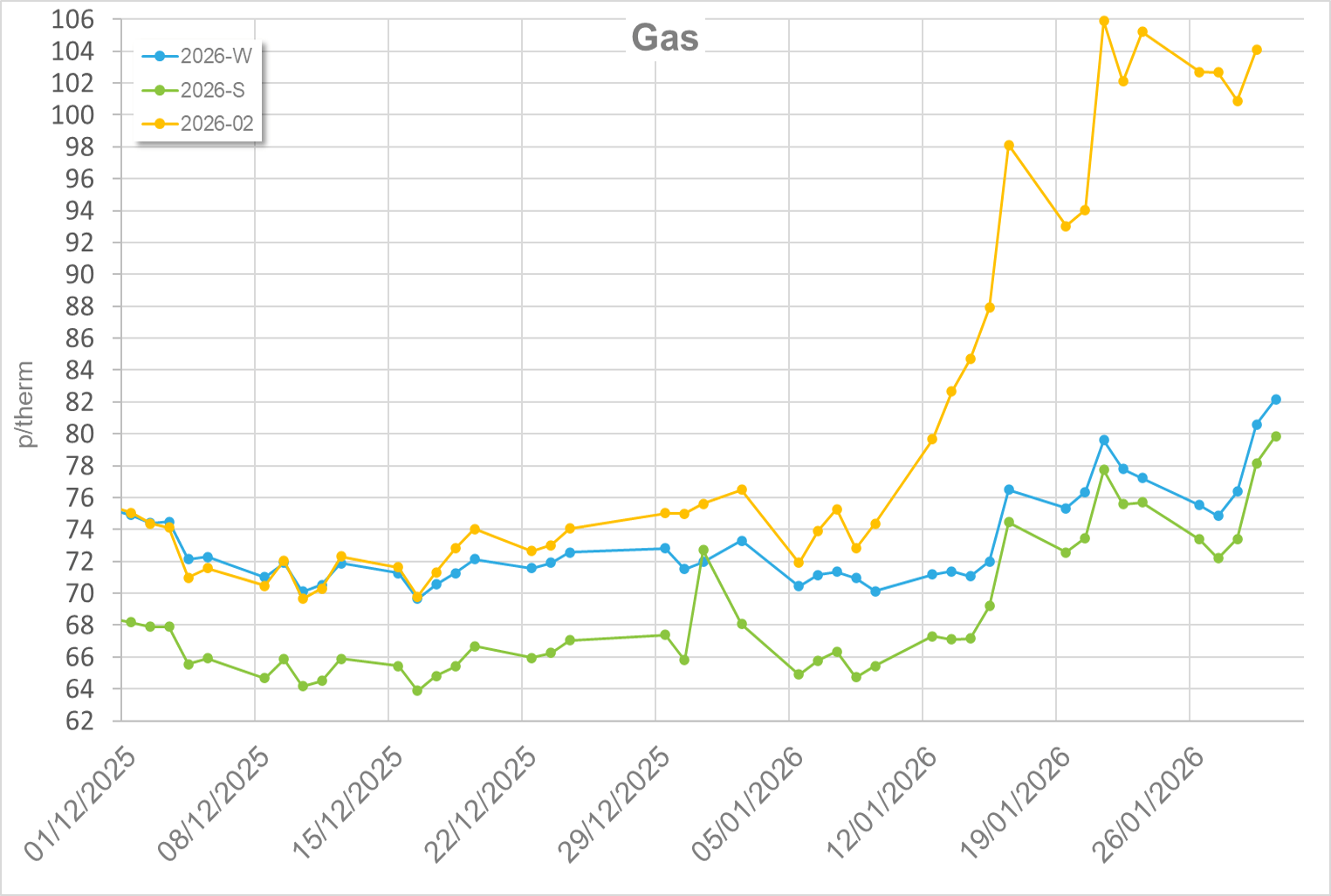

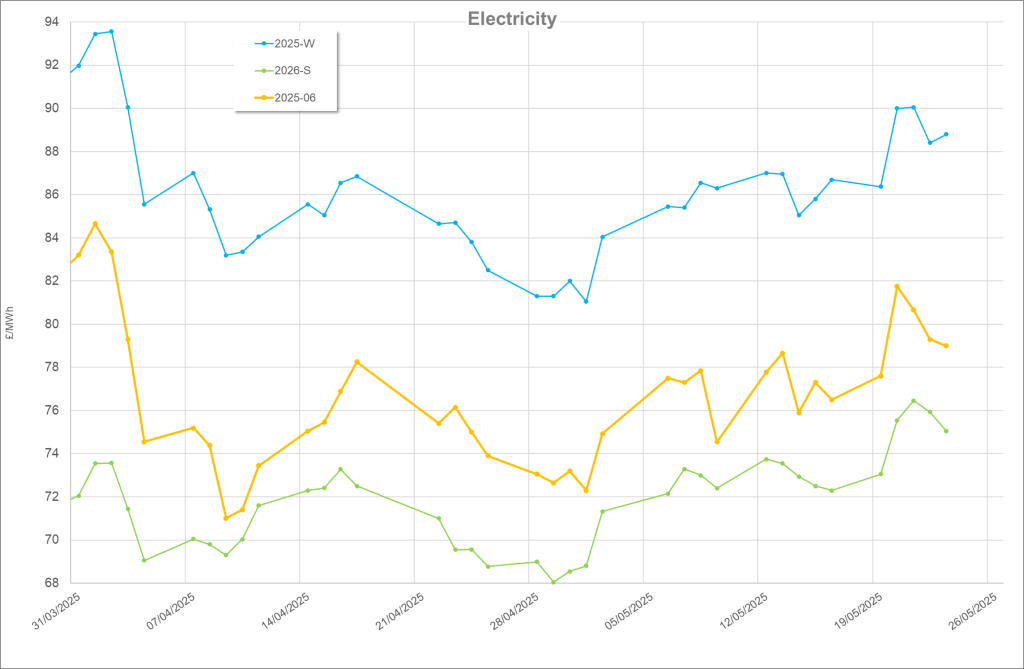

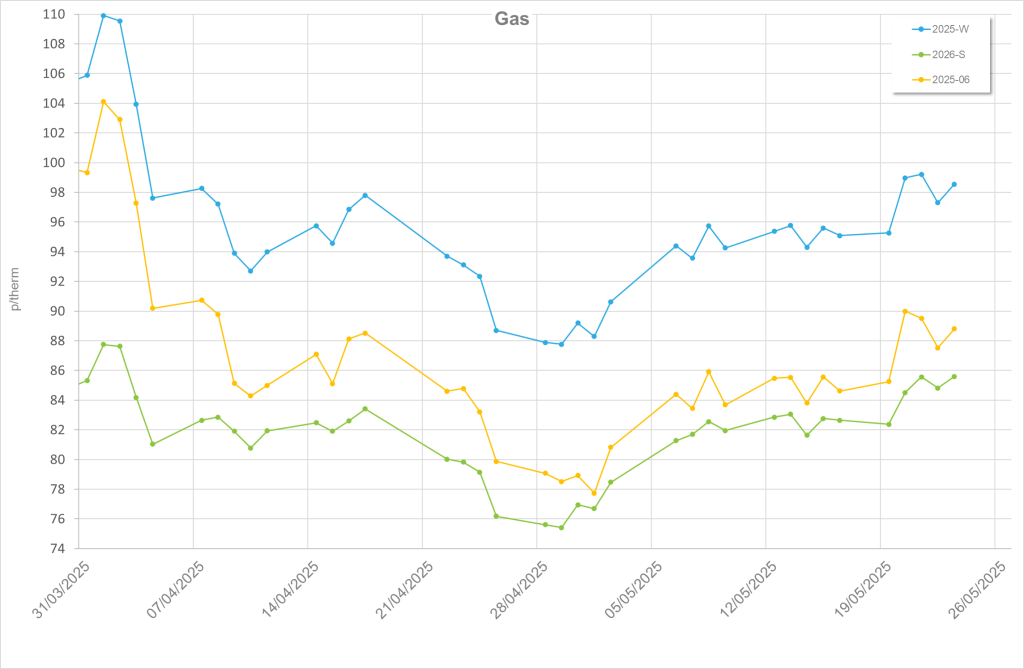

Meanwhile the US opened a new LNG facility in the Gulf of Mexico, Calcasieu Pass, which adds to the growing list of new US LNG facilities opened in the last six months. All in all, aside from a sharp decline in prices to coincide with the start of the Summer 25 trading period prices in April for May 25, Winter 25 and Summer 26 stayed remarkably calm.

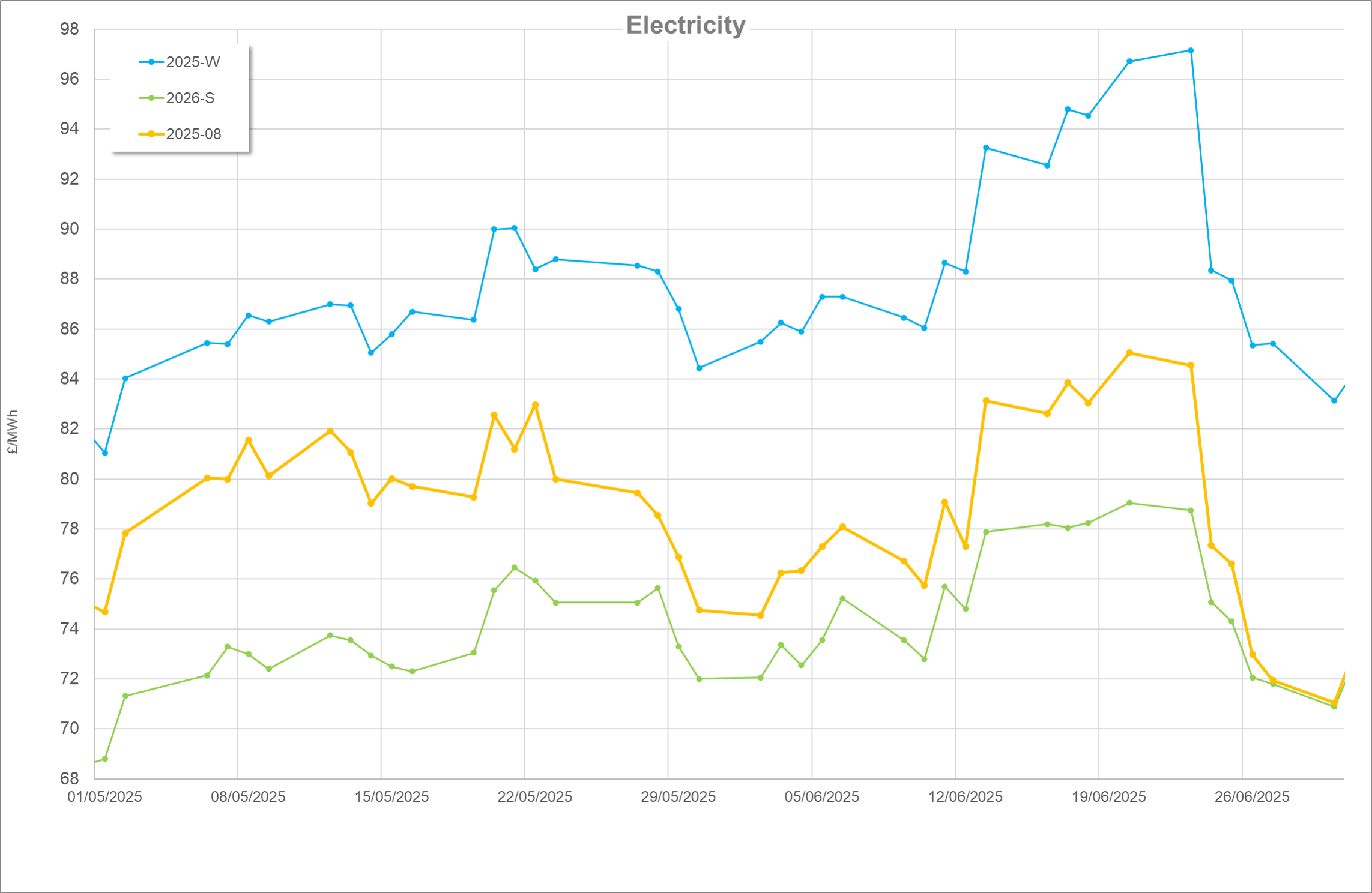

May

Thanks largely to a particularly windy end to the month and lower power demand, wind outperformed gas in the generation steaks by (at time of writing) 5%. Conditions were also favourable for solar which generated 11.5% of our electricity, up 3% from last year.

UK gas storage continued to be flat throughout the month. Although this is somewhat to be expected with the big chunks of Norwegian gas coming offline for maintenance during the month. An EU Roadmap outlined plans for additional legislation sanctioning remaining Russian energy sales to Europe. This includes a bold ambition to halt remaining LNG sales by the end of 2025. More information will be published in June which will be interesting as Slovakia and Hungary initially rejected the proposal. In any case it will be curious to see the effect this has on pricing.

The EU finalised its modified gas storage targets with 83% fullness between the 01 October and the 01 December being confirmed. This perhaps influenced a steady increase in EU gas storage throughout the month.

After the tariff spat between the US and China a 90 day pause in any tariff enforcement was announced. There were further peace talks between Russia, Ukraine and US to try and end fighting in Ukraine. The ceasefire chalked up for 8th-11th of May wasn’t observed with both sides blaming each other in a case of Deja Vous from recent attempted ceasefires. Peace talks broke down steadily throughout the month. Putin didn’t attend scheduled peace talks in Turkey and then a day before a rescheduled call between Russia and the US, Russia launched its largest drone strike on Ukraine since the invasion. This culminated in Trump again using inflammatory language towards his Russian counterpart, Vladimir Putin.

The largest chunk of Norwegian gas maintenance took place around the 21 May but the reports from Norway were that the maintenance was successful and to programme. Therefore, halting any price volatility as previously seen when things don’t go to plan. Lots of talk was focussed on the seasonal ramp up of Asian LNG demand to meet air cooling requirements. However, during the month of May this became a non-starter as demand stayed reduced from the eastern continent. There were no peaks and troughs in pricing, although there was a gentle list upwards in both gas and electricity largely centred on the Geopolitical developments in Ukraine.

Upcoming

With Norwegian maintenance window number 1 out the way with prices emerging unscathed we look ahead to the second window in August/September.

Traditionally wind renewables drop at this time of year so it will be curious to monitor how our renewables perform through the summer.

Trump seems keen to be the catalyst that brings peace to the Ukraine. However, with peace talks breaking down throughout April and May, his success remains to be seen.

It will also be interesting to see how the EU legislation regarding ending Russian energy into Europe pans out with an update expected in June.