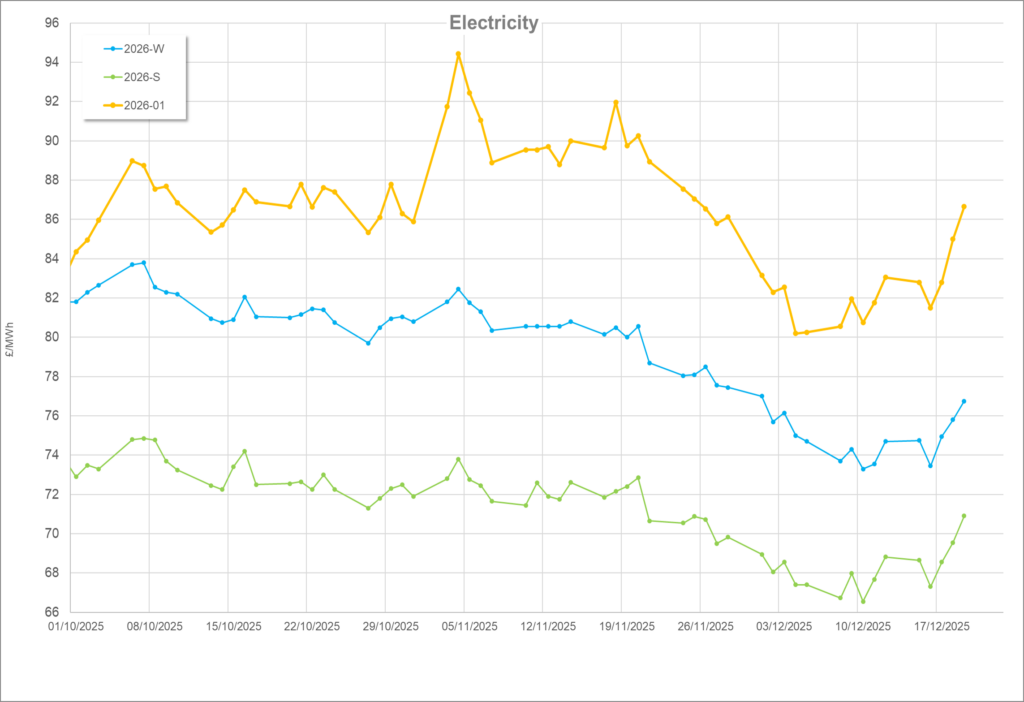

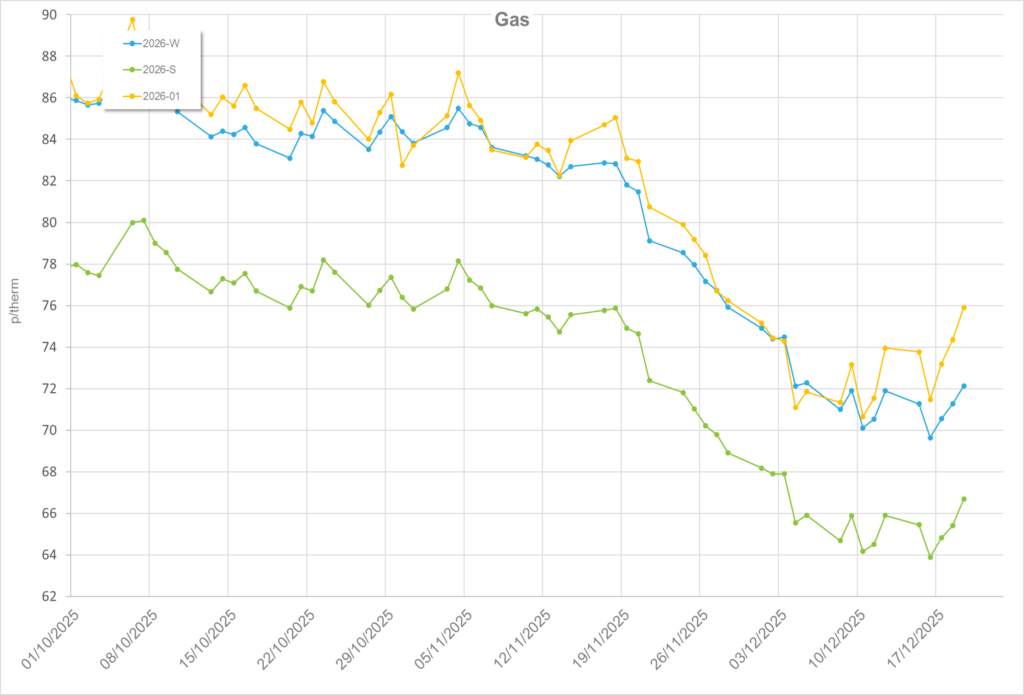

October

Prices held relatively firm during the month, albeit with a slight turn downward during the early parts of the month.

Despite a big lull in the middle of the month, wind production was particularly strong through October, partly due to Storm Amy towards month’s end. Temperatures gently declined, however they were largely above seasonal averages. This led to a much needed increase in both natural gas and LNG storage, the former of which was critically low during the majority of 2025. This occurred despite a smattering of unplanned outages amongst Norway’s gas fleet.

Despite UK’s low gas storage levels, mainland Europe were >90% full on average, showing a strong position as we moved into the Winter trading period. There were minor issues with the IFA1 interconnector with France, however, nearly 2TWh of power was sent to the UK during the month so the impact was negligible.

Russia was featured heavily in the news during the month. It began with announcements of the Arctic-2 LNG facility having exports to India and China despite a continuation of tariffs levied by Donald Trump. Additionally, the US and EU announced further coincidental sanction packages against Russia. Russian armed forces continued sustained attacks on Ukrainian energy infrastructure. Although the energy markets have mostly “got used” to this, it was the encroachment of Russian military drones into Polish airspace that drove brief spikes in prices.

In non-Commodity news, NESO announced a new raft of charge increases and changes. Balancing System Use of Service Charge was increased and a new charge, Regulated Asset Base, was introduced. With further news that the Transmission Network Use of Service charge was set to increase dramatically in the new year, October was a miserable time for businesses battling non-commodity costs.

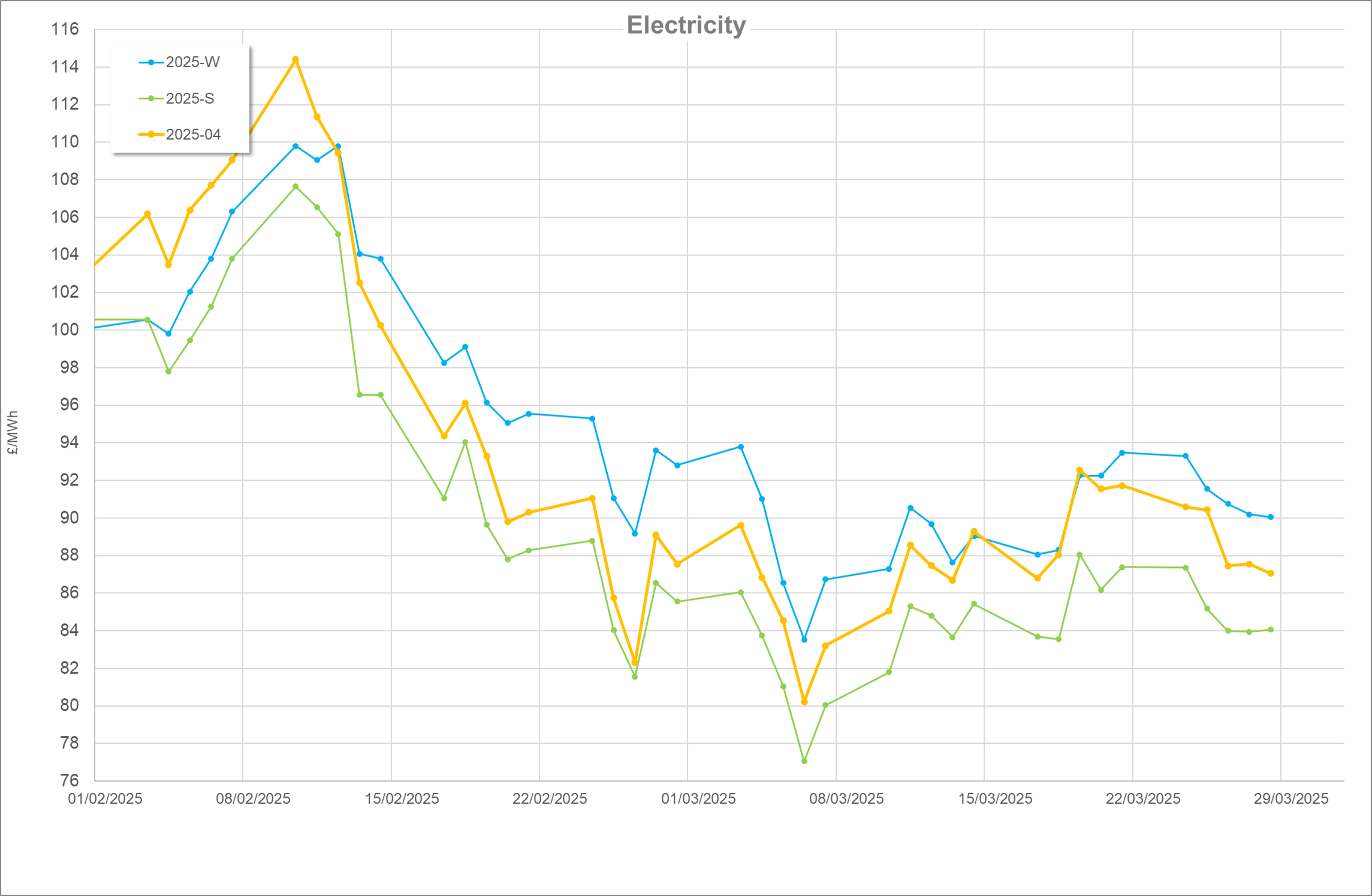

November

Price reductions, particularly in gas, gathered strong downward momentum in November.

Another month, another storm, as Storm Claudia helped spin wind turbines to great effect during the month. Once again, wind out performed gas by 10TWh to 7TWh of generation. Early power demand in the month was relatively low, but then climbed upwards towards the end of the month when temperatures decreased. Gas storage remained flat after injections during October, however with the last week of the month featuring declining temperatures, storage was called upon to help heat (and power) UK homes. Further delays to the Anglo-French interconnector IFA returning to full capacity were announced with established capability expected in January 2026.

The EU held discussions about recirculating seized Russian assets into the Ukraine to help support war efforts. The timing between this and Russia announcing it had tested new nuclear weaponry was curious. Additional strikes on both Russian and Ukrainian energy infrastructure were announced, however this did little to taper the reductions in prices.

News out of Greece may have supported reductions in prices as they stated that they were going to relay US LNG into Ukraine through the Winter period to help alleviate strain on EU supply and storage.

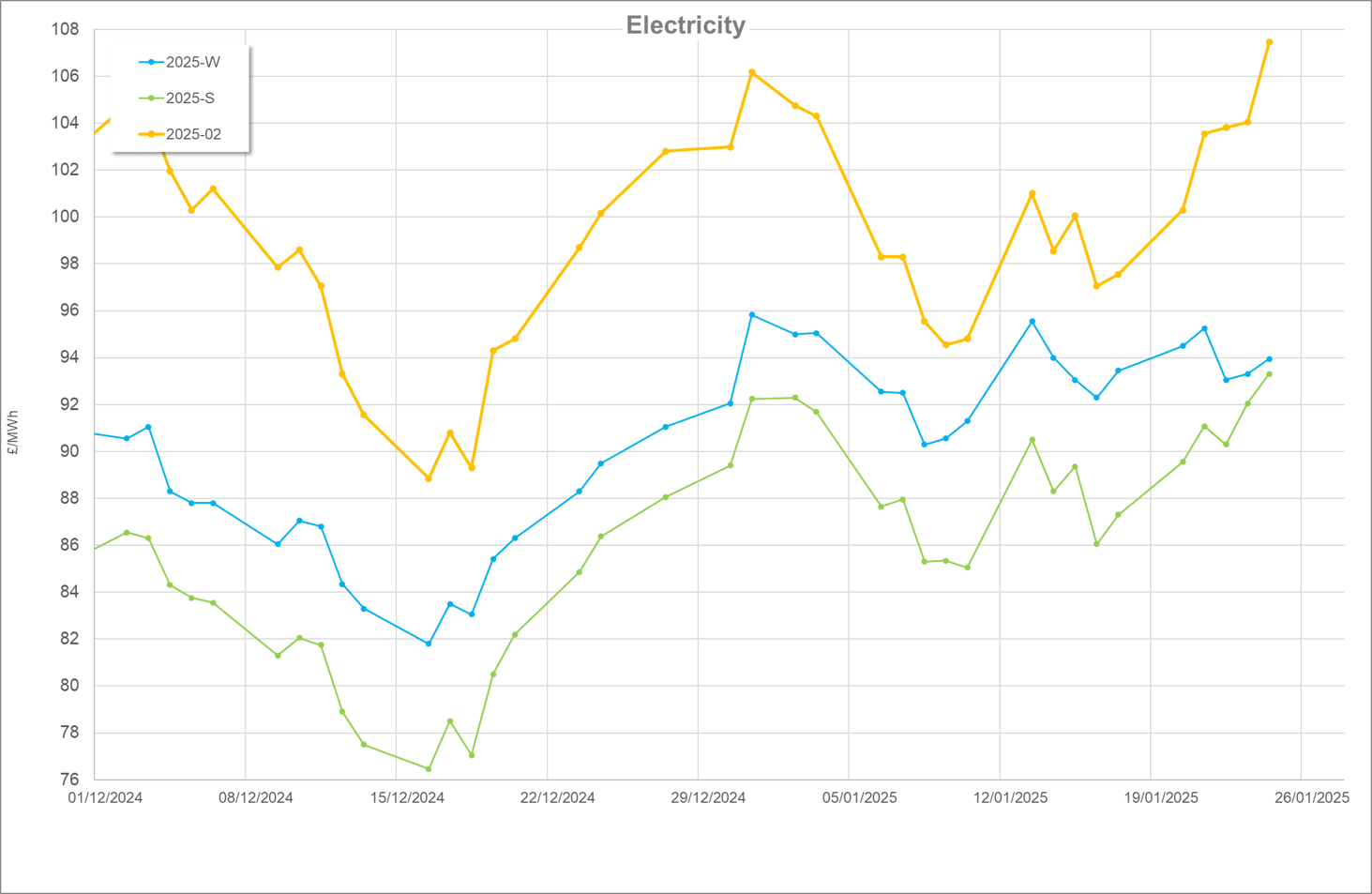

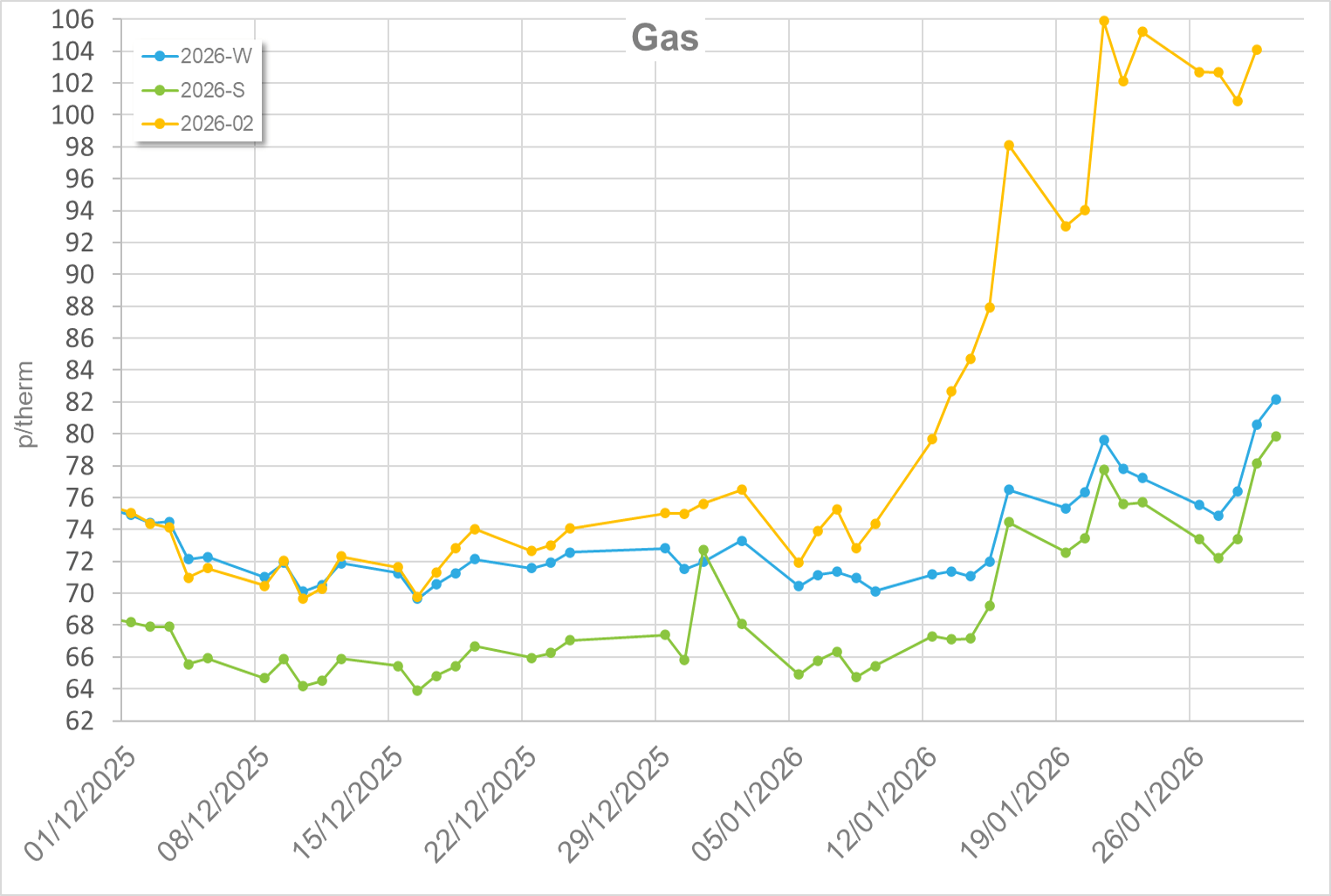

December (to date)

Price decreases from November halted and began to fluctuate upwards.

Gas storage increases resumed with a gentle but steady flow into the tanks. Wind generation has again outperformed gas 8.10TWh to 5.10TWh. This time it was Storm Bram that stoked the winds of generation. Nuclear, biomass, and imported generation have yielded similar and steady volumes.

With Russia piping gas into Asia, the effect of seasonal and seaborne LNG cargos on UK markets has seen relief this winter. There were some renewed talks of a peace deal in Ukraine, however a speech by Putin towards the middle of the month seemed to reinforce his territorial stance. Tensions rose between Venezuela and the US after oil and LNG tankers were blocked by the US. In summary thus far, unlike December 2024, it has been a slow news month as we head into the Christmas break.

Written by Ed Kimberley