August Recap

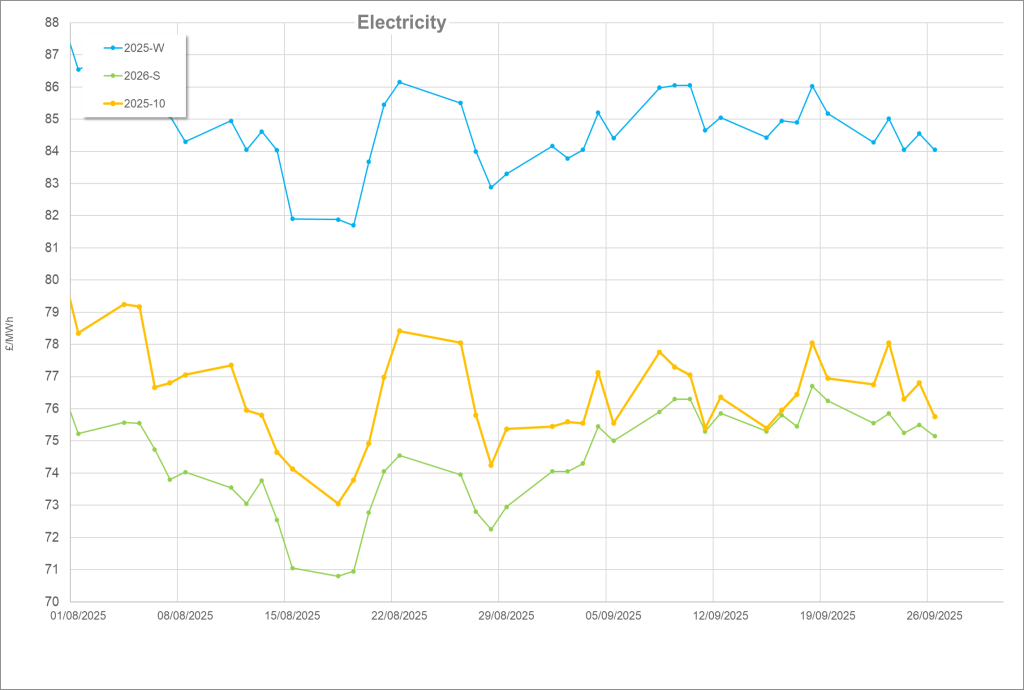

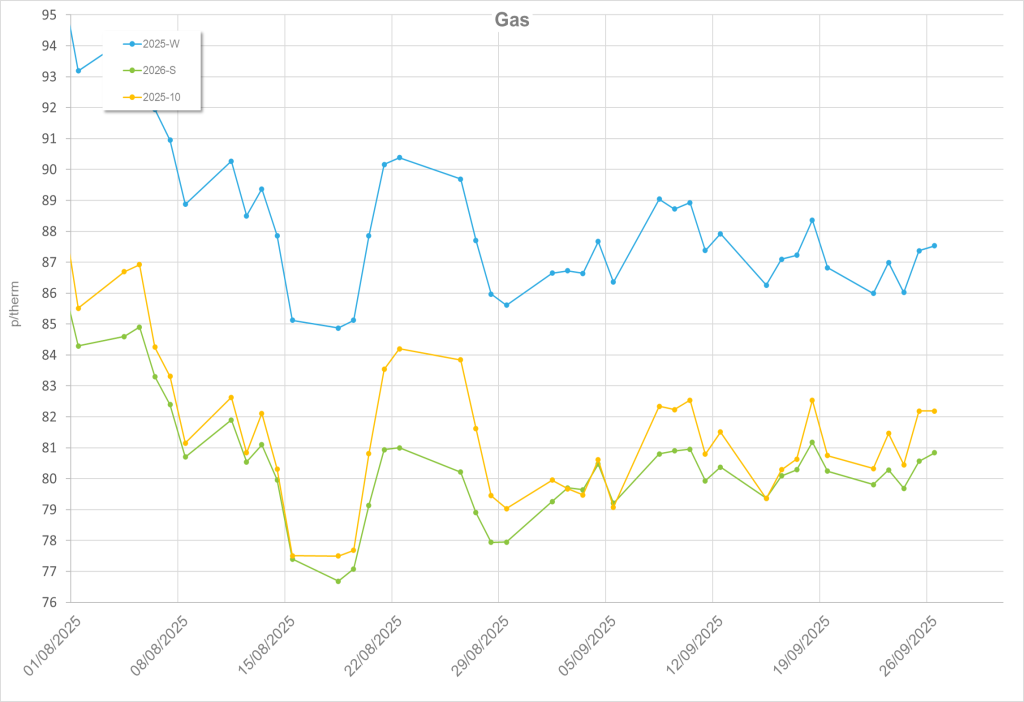

We observed a slight increase in wind conditions which helped wind surpass gas in the generation mix. Gas storage struggled to pick up and although Norwegian maintenance could potentially disrupt this activity, previous years have seen injections occur during August. With no improvement here, the markets were surprisingly calm as we moved closer to the Winter 2025 trading period. Norwegian maintenance towards the end of the month saw a small bump in prices in a month that generally saw downward momentum.

In geopolitics, Russia announced a ramp up of its Liquified Natural Gas output from Siberia and Arctic 2 terminals. Despite this, the markets barely responded and continued its downward listing. This was especially curious, as in the wake of this change, Trump announced some additional tariffs against India who had purchased some of the new Russian cargos. With still no end in sight for the Russian Ukrainian War, any peace talks were deferred into September.

September

Wind generation surged throughout September and dominated gas throughout the month (7.85 TWh to 4.85 TWh respectively). This was particularly welcome at the start of the month to coincide with the large periods of Norwegian gas maintenance. Despite relatively low gas demand, storage was remarkably flat during September. Surprisingly, pricing followed an eerily similar pattern, and no significant peaks or troughs were observed.

French nuclear output was mixed, with issues due to strikes and jellyfish swarms interfering with river cooling methods. As a result, imported power from France was down approximately 0.5 TWh in August. However, the UK’s domestic wind output increased to compensate. Temperatures were relatively steady throughout the month. However, the final quarter of the month saw the UK cool ahead of the winter period, but this did little to stir the prices.

Russian attacks on Ukrainian energy infrastructure continued, with attacks on Odessa and Kyiv being particularly prominent. We also saw an increase in attacks in the Middle East after Israel struck Qatar. Curiously, things cooled off quickly despite a step that could have seen further escalations in the region and subsequent price uncertainty.

Overall, it was a strange month for market prices. With minimal gas storage, Norwegian maintenance, geopolitical uncertainty, and cooler weather afoot, prices could have driven upwards. However, prices remained stable. With October’s colder temperatures upon us, it will be interesting to see how the markets respond.

Written by Ed Kimberley