In September 2022 the government introduced the Energy Bill Relief Scheme (EBRS), which enabled business to access support for energy bills when costs raised above threshold amounts for winter 2023 purchases. This scheme, which allowed many businesses to continue trading during the period of highest energy costs, came to an end on the 31st March and has been replaced by the Energy Bill Discount Scheme (EBDS), set to run until 1st April 2024.

Whilst the EBDS is very similar in concept to the EBRS, the key differences between the two are the threshold values, at which support will start, and the value of support on offer. There are also two different support levels depending on the energy intensity of the business.

Non-energy intensive businesses

This classification covers most of the businesses in the UK, including commercial Horticulture. The following table describes the threshold costs at which support will start and the value of that support for growers:

| Commodity type | Price at which support starts | Price at which support maxes out | Maximum support available | Maximum support as a percentage of energy cost |

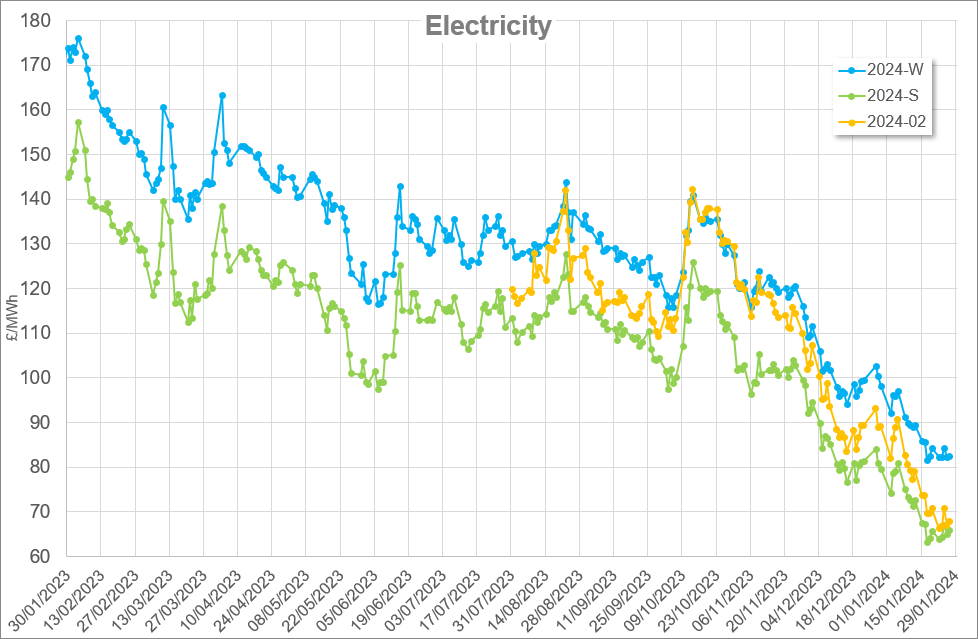

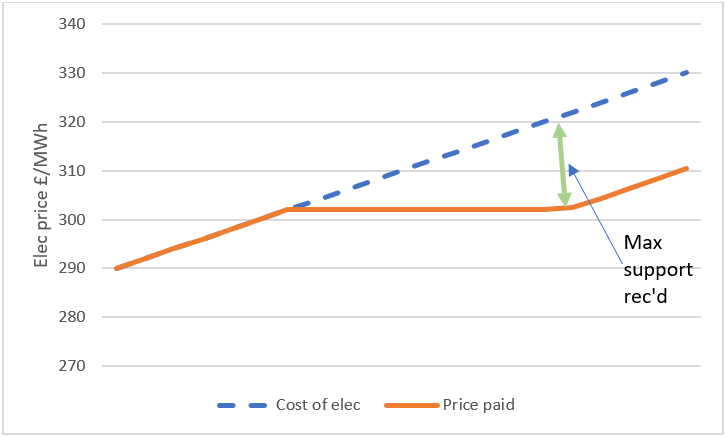

| Electricity | £302/MWh (30.2p/kWh) | £321.61/MWh (32.1p/kWh) | £19.61/MWh (1.961 p/kWh) | 6.1% |

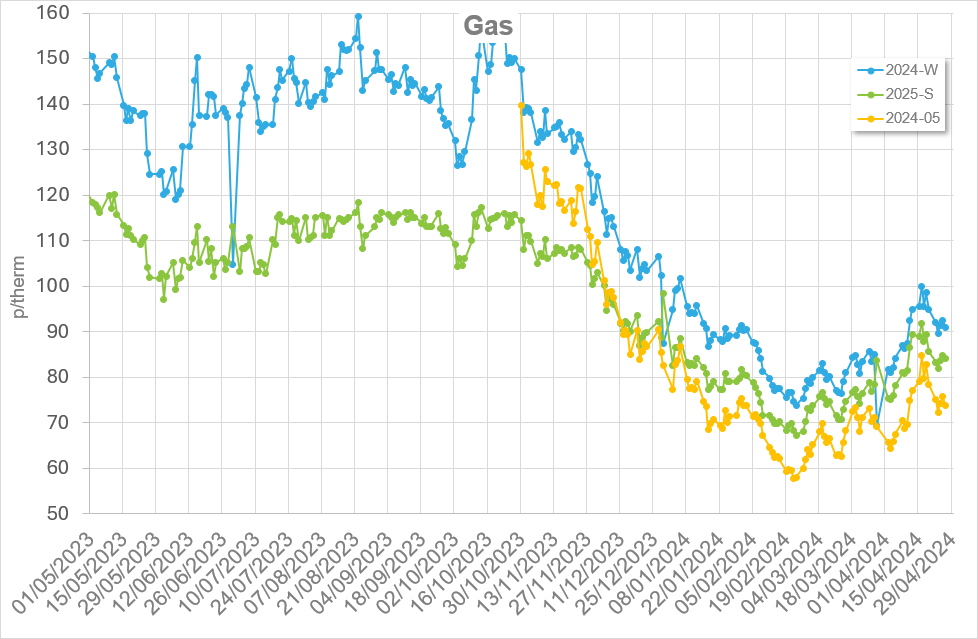

| Gas | £107/MWh (313.51p/therm) | £113.97/MWh (333.91p/therm) | £6.97/MWh (20.4p/therm) | 6.1% |

If the commodity cost paid by the business exceeds the threshold amount, then the support will be triggered, up to the maximum value as shown in the table. For example, as the electricity costs exceed £302/MWh then support will be available as a ramped value until the support amount reaches £19.61/MWh, and will remain at this level for all electricity purchased above £321.61/MWh, as shown in the chart below.

The discount will be applied automatically by your energy supplier and the full Government guidance for non-energy intensive businesses can be found here: Energy Bills Discount Scheme.

Energy intensive businesses

The government recognise that energy intensive businesses are more sensitive to energy price volatility than others and have therefore decided that additional support would be available for these business types, unfortunately this currently does not include commercial horticulture (the full list can be found here), however however at the latest Farming Summit (Farm to Fork – 16th May 2023) there were pledges made to address this imbalance.

The scheme works in much the same way as for non-energy intensive businesses, the key differences are the amount of support available, the threshold that it is triggered and the volume of energy that will be covered.

The volume of energy supported will be 70% and this must be used through a contract that was started on or after December 2021. The remaining 30% will receive discount in line with the non-energy intensive businesses.

| Commodity type | Volume | Price at which support starts | Maximum support available | Maximum support as a percentage of energy cost |

| Electricity | 70% | £185/MWh (18.5p/kWh) | £89/MWh (8.9 p/kWh) | 32.5% |

| Gas | 70% | £99/MWh (290.07p/therm) | £40/MWh (117.2p/therm) | 28.8% |

| Electricity | 30% | £302/MWh (30.2p/kWh) | £19.61/MWh (1.961 p/kWh) | 6.1% |

| Gas | 30% | £107/MWh (313.51p/therm) | £6.97/MWh (20.4p/therm) | 6.1% |

Crucially giving of Energy Intensive businesses support is not automatic and an application must be made to the energy supplier, which must be completed within 90 days of the 26th April 2023 (22nd July 2023) or 90 days from becoming newly eligible. This application must be made regardless if current energy costs are below the threshold, full details available here: Apply for the Energy Bills Discount Scheme support for Energy and Trade Intensive Industries.

Authored by Jon Swain.