Looking back – March

March was mostly a good month for energy fundamentals. Less gas was burned for power generation compared to February, while Wind outputs were comparable to those in February. Also observed were small increases in Solar production (expected with the lengthening daylight hours) and Imports from France’s Nuclear fleet occupied a greater market share compared to February.

Although the front part of the month remained below seasonal norms, temperatures rose steadily until mid-month where prices remained above/on par with seasonal norms. This helped keep the gas demand low and National Gas’ published demand was often as much as 50MCM/day below normal seasonal demand. This is due to a combination of weather conditions, increased renewables in the market and also, I would venture, domestic consumer behaviours fresh out of the Energy Crisis.

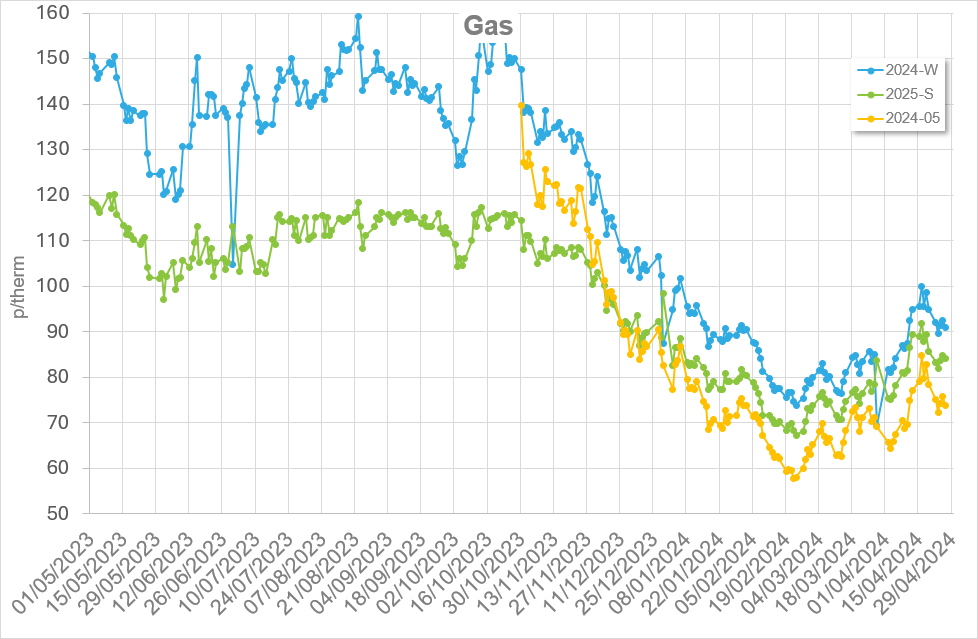

Storage levels through March fell below last year’s position, but rose gradually towards month end in line with the EU policy that storage needs to be 45% full by 1 May. The Tyra gas field off the coast of Denmark came back online after ~3 years of upgrades. Oddly the prices didn’t react much to this news, however it is worth noting because the site will be important in North West Europe’s energy balance for years to come.

Liquid Natural Gas (LNG) continued to help bolster the UK’s energy prices. This was largely despite continued Houthi Rebel attacks in the Red Sea, although some sources cited the volume of attacks tapered off towards month end, likely due to being low on munitions. The main news item that counterbalanced and kept fundamentals strong were led by an increase in LNG demand from the Asian market. Also of significant importance was the escalation of strikes against critical energy structure in the Ukraine War. Ukraine led drone strikes against Russian infrastructure meanwhile the Russians targeted gas storage and power stations in Ukraine.

This month – April

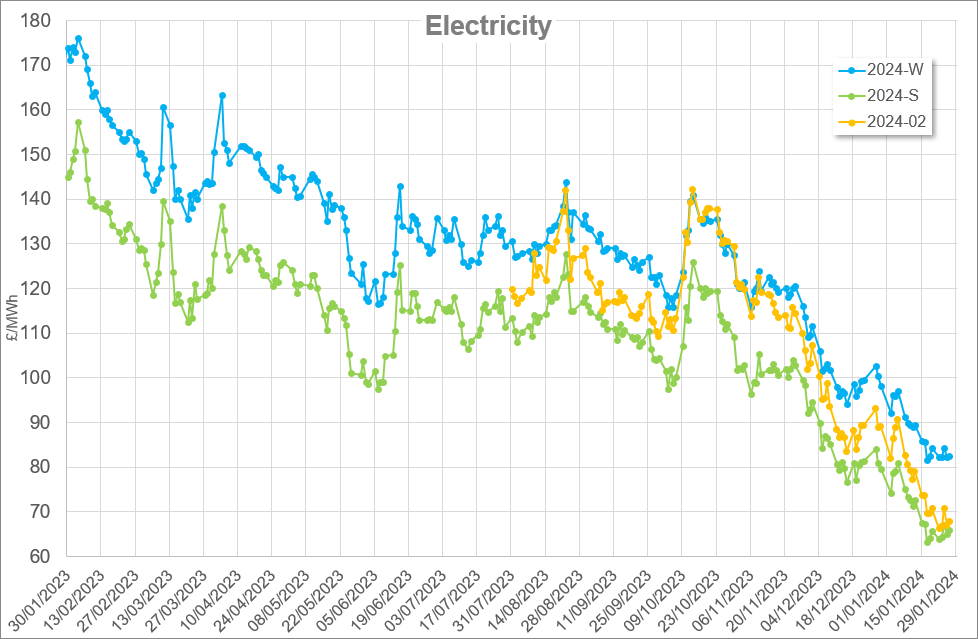

Again, fundamentally the UK energy markets were in a good place. To date Electricity generation from Wind has more than doubled the output from Gas (37% vs 15%), this was largely thanks to Storm Jocelyn and its slow unfurling through weeks 1 and 2 of the month. This however was bad news for electricity periods and there were large periods observed on the N2EX market where prices tipped into the negative.

Similarly to March, despite a colder period towards month end, gas demand remained heavily under National Gas’ average. Gas storage saw good levels of injection and to date has surpassed the EU target of 45% by 1 May. The injections into storage, it is worth noting, are despite outages at several Norwegian gas facilities throughout April. As well as unplanned outages, the month saw the start of the Spring & Summer maintenance window. LNG continued into Europe and news of the Houthi Rebels continued to peter out in line with patterns observed in March.

Where one market driver exited the news, another entered that saw prices rocket during week 2. This was the ignition of a series of missile and drone strikes exchanged by Israel and Iran. The RAF and USAF where reportedly involved coming in to help defend Israel. With ongoing instability in the market due to ongoing fighting in Palestine, this news added further negative sentiment into the market with the Winter ‘24 gas price peaking above 100p/therm for the first time since December 2023. At time of writing the prices are starting to soften again, however are currently still at elevated levels from month start. Some are suggesting that this is due to a general cooling off particularly on the Israeli side. Attacks on Ukrainian Energy infrastructure meanwhile continued with Kyiv’s main coal fired power station suffering damage leading to Blackouts. Reports in the news suggested Ukraine’s anti-air defences were running critically low, however Ukraine launched its own drone strikes on Russia.

Looking Ahead – May

Close attention clearly needs to be paid to events in both the Middle East and Ukraine. The most recent forecast looks like wind and temperatures will return to normal. Summer ‘23, Winter ‘23 and April ‘24 were on the whole mild and windy which helped soften energy prices. As mentioned above we’re now into Norwegian gas maintenance season. Although these dates should be included in pricing, any delays to return or unplanned outages could be troubling for prices. Last summer the French Nuclear fleet also helped prices with renewed outputs following a poor 2022. The French can struggle with maintenance, in addition to river temperatures being used for cooling being something to watch out for.

Written by Ed Kimberley