Last month’s round-up – December 2023

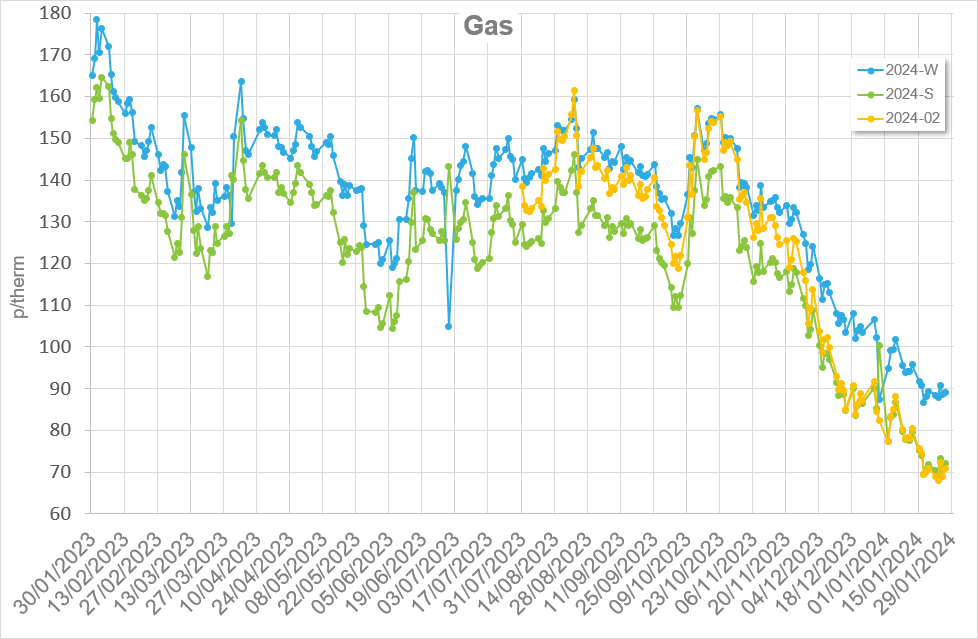

The early part of December saw the price of gas and power increase as the UK endured its first cold spell of the winter. That said, increases were minor and short-lived as temperatures recovered, storage retained good levels, wind picked up and a consistent flow of gas was observed from Norway. By the tail end of week 1, prices reverted back to a decline which was the general trend of December.

A slight fly in the ointment were attacks by Houthi Rebels on shipping through the Red Sea, this briefly saw prices increase again toward the middle of the month due to concerns primarily around liquid natural gas (LNG) shipping. The ongoing conflict between Israel and Hamas continued through December. The effects on the UK were not fundamentally driven as the Tamar Gas Field ramped up export indicating no effect on the supply/demand chain, but there is some nervousness that the conflict could expand further into the Middle East.

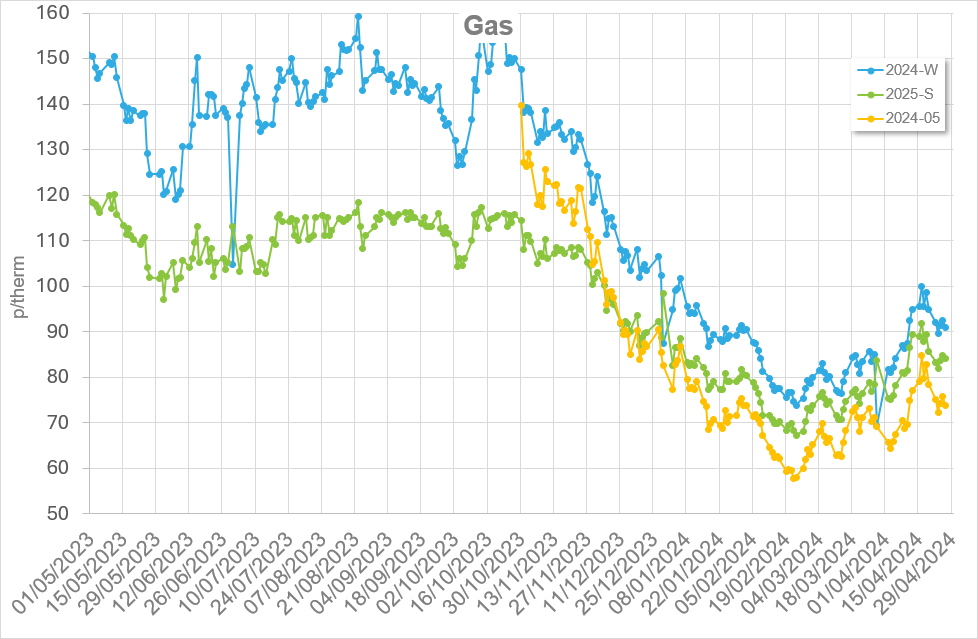

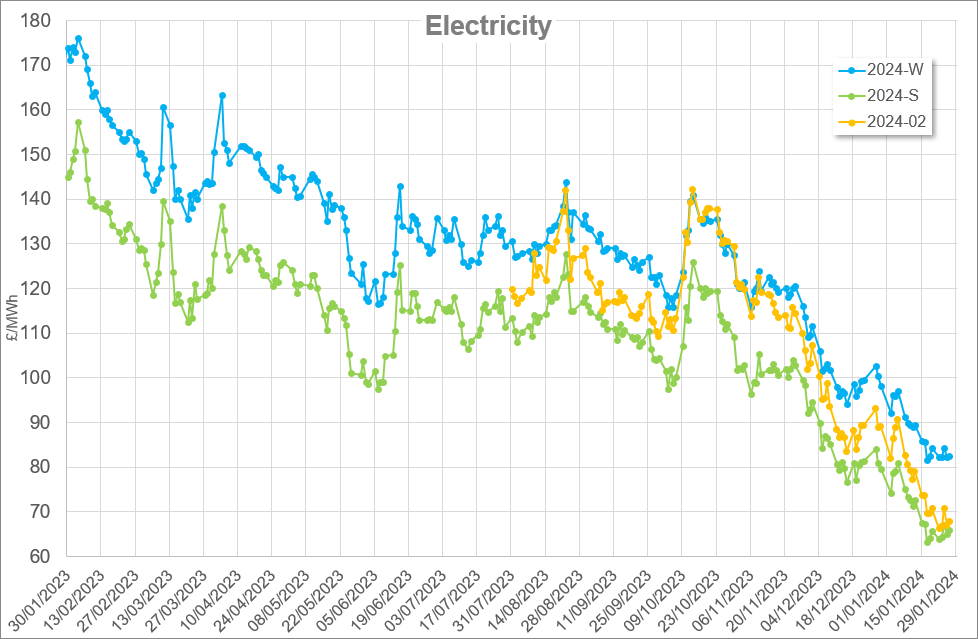

As both Gas and Power demand reduced significantly during the Festive Period, prices plummeted, particularly Winter 24 Gas which fell from 105p/therm to 86p/therm almost overnight. With the milder temperatures and lower demand during the latter stages of December, the UK heavily injected into storage and ended the year close to 100% full. The UK and Denmark also shared its first power via Viking Link, most of this is flowing from Denmark to the UK and provided an extra boost to energy security.

This Month – January 2024

The early stages of January saw typically low levels of demand for gas and power as the UK slowly emerged from its festive break. During Week 2 the expected supply/demand ramp up coincided with calmer wind conditions however the prices continued to steadily decline particularly in Power. Interestingly Week 2 saw the first full week since midsummer 2021 where the Summer and Winter seasons prices ahead were both under 100p/th and £100/MWh, a sign of the growing market confidence.

There was a minor outage at a Norwegian gas facility which saw around 15MCM of gas offline for a handful of days. This coupled with a sharp decrease in temperature during the latter stages of Week 2 saw the Gas prices initially plateau. Further confidence in the markets was observed during Week 3 as despite prolonged periods of cold temperatures, and lower Wind outputs the gas and power prices continued their downward momentum. This can be largely attributed to a more robust storage strategy from the UK as far back as Spring 2023 in preparation for this Winter, good interconnections with the continent and an increase of LNG from new sources such as the USA.

Having countries supply the UK from a variety of locations such as the USA, Peru, Egypt, Nigeria has limited the disruption caused by the ongoing fighting between NATO and Houthi Rebels. This also escalated during the latter stages of January with the RAF joining with the USAF in striking Houthi strongholds and attack boats. Storm Isha and Storm Jocelyn in quick succession saw a leap in Wind production towards the end of Week 3 and into Week4. This coupled with temperatures increasing after the cold spell saw further decreases across Gas and Power.

The mid stage of Week 4 showed prices plateauing in response to some mixed fundamentals in Europe. This was a combination of LNG disruption through the Red Sea, a notable drop in Wind and Solar, and a marked increase in storage withdrawals. Fundamentally however the UK is polarised to this. Good wind continues off the back of the two Storms, a significant drop in gas demand (by around 100MCM a day) due to the temperature increases has seen the UK inject into storage and a constant stream of LNG continues to come into our ports.

Looking ahead – February 2024

As the markets are behaving more confidently, predicting the effect of fundamentals is more successful. Forecasts are showing solid Wind production certainly through the early part of February with temperatures also forecast to above seasonal norms. It is worth keeping an eye on the ongoing situations with the Houthis, as well as those between Israel and Palestine, Russia and Ukraine, and most recently Iran and Pakistan. Escalations in the Middle East that affect large Gas and Oil exporters, such as Iran, could have a sizeable knock-on effect in the supply/demand mix. With a General Election due in 2024 close attention should be paid to the various party’s policies, not just on energy, and any subsequent market movements in response. Should a “Liz Truss effect” happen again, this could undo some of the market softening over the last few months.

Written by Ed Kimberley